PROVIDENCE – Disneyland started with the iconic Sleeping Beauty Castle.

The rest came later.

And according to Gov. Daniel J. McKee, the 10,000-seat United Soccer League stadium anchoring the Tidewater Landing project is Pawtucket’s Disney castle: build that first, and the accompanying housing, commercial space, parking and infrastructure will follow.

McKee on Tuesday used this logic in explaining the latest funding pitch for the riverfront development in a meeting of R.I. Commerce Corp. on Tuesday.

The ask: funnel all of the already-approved state bond money into the soccer stadium, rather than spreading it out across the later phases of public infrastructure improvements.

“Build the castle first,” McKee said.

But where McKee sees a fairytale future, Commerce board members fear the story ends in an empty stadium that puts the state millions of dollars in the hole.

Their main concern: if the state shifts all $36.2 million of approved tax-increment financing into the stadium – rather than just the $5 million chunk they originally planned – what’s left for the rest of the project?

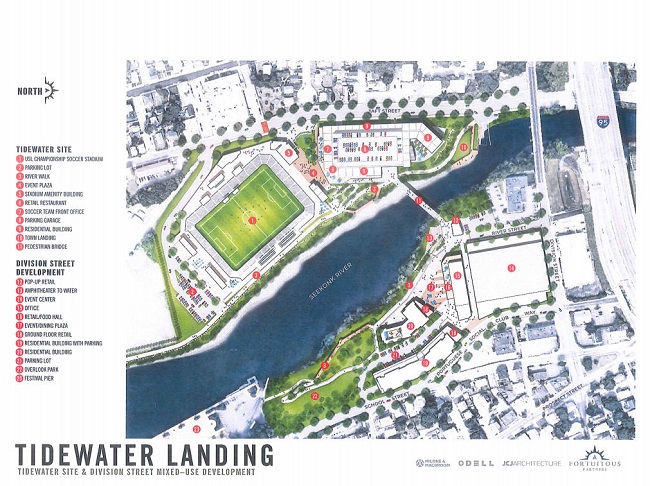

In addition to the stadium, the project also includes an outdoor event plaza and a riverwalk connecting the two sides of the Seekonk River, along with 435 housing units, a parking garage, and retail and commercial space.

The cost of the project was originally pegged at $284 million, but is now estimated to cost $344 million due to inflation and supply chain problems, with the soccer stadium alone increasing by nearly 50% to $124 million.

“We’re kicking the can down the road,” said Michael McNally, Commerce board member. “We’re going to end up with a stadium and nothing else.”

Project proponents, including those with the city and developer Fortuitous Partners, sought to reassure Commerce members that that won’t happen. A master development agreement inked between the city and the developer sets deadlines for construction and financing of the other parts of the project, with penalties if they don’t make good on those terms, said Sandra Cano, the city’s commerce director and a state senator.

Bernard Buonanno, also a Commerce board member, also questioned the economic return from a stadium-only development.

The project in its totality is expected to create more than 2,500 direct and indirect construction jobs and 1,200 permanent jobs, while adding $130 million annually to the state gross domestic product, according to data shared by the city in 2019. But economic projections from the stadium alone have not been shared publicly.

“I expect it’s not going to be very attractive,” Buonanno said.

While McKee said the new financing plan does not call for additional state funding, the long-term plan will involve another $20 million in state bonds to be considered in the next legislative session.

Meanwhile, the city of Pawtucket, which will also take on about $9 million in debt as part of the $36 million tax-increment financing agreement, will kick in another $10 million in funding, at least part of which will come from property tax revenue paid by the developer, which is leasing the site from the city, according to Pawtucket Mayor Donald R. Grebien.

The developer has agreed to put in another $45 million in private equity and $31 million in private debt investment to cover the higher costs.

With the city taking on more borrowing under the reworked TIF agreement, the developer will also pay additional property taxes to the city and enter into a profit-sharing agreement with the city and state, a step “almost unprecedented” in these kinds of deals nationwide, according to a statement from the developer. Details of this profit-sharing agreement and property tax payment were not immediately available.

The tax-increment financing structure already acts as a kind of profit-sharing mechanism, since revenue generated from the project will be used to pay back the state and city bonds.

The latest funding plan comes after a prior request to have the state pitch in another $30 million in borrowing, of which Commerce members were also skeptical. In recent weeks, a chorus of city and state leaders have urged them to agree to the necessary funding changes needed for the project to come to fruition.

“Pawtucket already lost the PawSox,” Lt. Gov. Sabina Matos said in a tweet on June 10. “Neither the city nor the state can afford to watch another developer and another team walk away before they even get here.”

Municipal leaders representing the Blackstone Valley area also sent a letter on Tuesday calling the project “essential for the future of commerce in the Blackstone Valley” urging R.I. Commerce to “take action to ensure that the development does not end here.”

The pressure has ramped up.

McKee said Tuesday that he was not asking the board to make an immediate decision, though he also stressed the urgency behind moving the project forward. No votes were taken, but an executive session discussion resulted in “mixed consensus” to at least take the proposal under more consideration, McKee said.

In addition to the already approved $36.2 million TIF for the project, R.I. Commerce has authorized $10 million in net state tax credits for the project.

(UPDATE: Adds information in the 17th paragraph from Mayor Donald R. Grebien about the $10 million Pawtucket would contribute as part of the project, as well as information in the second-to-last paragraph that no votes were taken at Tuesday’s meeting.)

Nancy Lavin is a PBN staff writer. You may reach her at Lavin@PBN.com.