PROVIDENCE – An analysis of Partners HealthCare of Massachusetts’ proposed acquisition of Care New England predicts the latter’s financial losses will inspire Partners to find ways to increase revenue, which could threaten the affordability of Rhode Island’s commercial health insurance premiums by seeking rate increases, but Health Insurance Commissioner Marie L. Ganim is confident her office can keep rates reasonable.

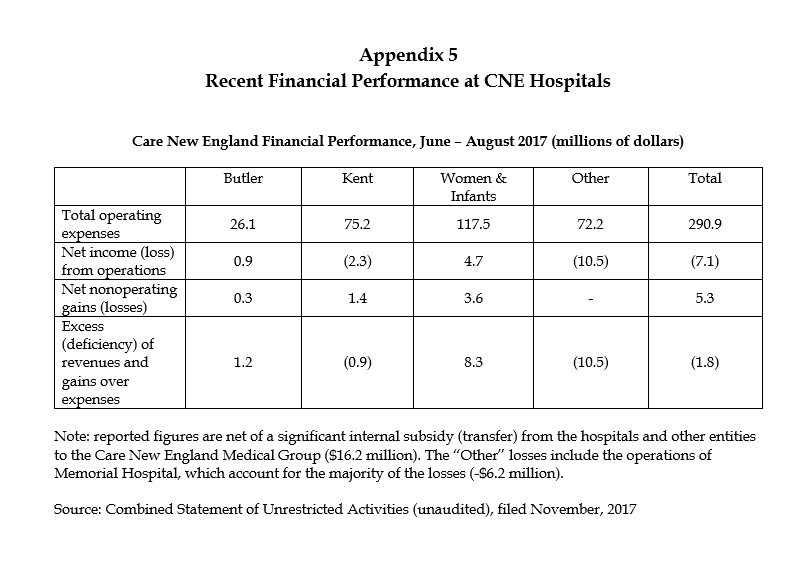

New revenue will be a likely goal of any entity that owns the financially troubled CNE, according to a Feb. 4 analysis by Balit Health commissioned by the Office of Health Insurance Commissioner. CNE reported a $68 million loss from operations in fiscal year 2016, a $47.1 million operating loss in fiscal 2017 and a $33.7 million operating loss for the first quarter of fiscal 2018.

Balit Health created its report using insurer interviews, literature evaluating the impact of health care consolidation, discussions on the history of Partners’ market behavior in Massachusetts with a member of the Massachusetts Health Policy Commission and commission staff. The company also consulted with Martin Gaynor, an economist and faculty member of Carnegie Mellon University and former director of the Bureau of Economics at the Federal Trade Commission.

“If only because of CNE’s financial distress, we find it likely that if Partners acquired CNE, it would take actions to increase revenue to CNE, which, if successful, would adversely impact the affordability of Rhode Island commercial health insurance premiums in the immediate term. The financial realities imply that another acquiring entity would be likely to attempt the same, albeit perhaps with less insurer leverage than Partners,” according to the report.

Ganim said she’s confident her office can continue to keep health insurance rates affordable for Rhode Islanders despite the report’s warning.

“We know that our hospital rate cap has been working to keep costs down,” Ganim said of the percentage increase the state allows hospitals to apply to reimbursement rates charged to insurers each year. That rate is set at the consumer price index urban percentage each October, 1.7 percent in 2017, plus 1 percent, for 2.7 percent this year.

“The Health Insurance Commissioner’s market impact study is the first review by a regulatory agency of the proposed acquisition of CNE by Partners and it raises real concerns about motivations and outcomes if this ill-advised merger were to come to fruition,” said Bill Fischer, spokesperson for regional care network CharterCARE Health Partners.

Ganim said she and her staff are also mindful of the impact of health insurance costs on businesses in the state. She noted that during OHIC’s meeting Monday, Mark Van Noppen, owner of Armory Revival Co., said he had considered discontinuing health insurance for his 25 employees due to the cost.

“We have to keep this in mind when we act on these things,” Ganim said.

The report also cast doubt on the likelihood that CNE can be made profitable before the merger is complete, despite the recent closing of Memorial Hospital of Rhode Island in Pawtucket.

“Partners’ past acquisitions have not been distressed hospitals, and Partners has stated publicly that it will only finalize the CNE transaction if CNE can become profitable. While CNE’s actions to close Memorial Hospital will improve its financial performance, one interviewee stated that Partners goal is to have hospitals run a 1-2 percent margin, and expressed skepticism that CNE could get to that point prior to the acquisition,” the report continues.

The report also identified several likely reasons for Partners HealthCare’s interest in purchasing Care New England:

- Higher referral volume for high-margin services: “Partners may see an opportunity to direct more Rhode Island care to its Massachusetts facilities,” according to the report.

- Building market share within Rhode Island: Partners has pursued growth through practice acquisition and developing new outpatient facilities in the past, the report states.

- Adding margin: “Some believe that by increasing revenues at CNE, Partners may believe it can make CNE profitable, with revenue increases coming from a combination of higher hospital and physician payment rates and increased utilization. Partners may also see an opportunity to lower CNE operating costs,” the report says.

- Value-based contracting: “In Massachusetts Partners has sophisticated value-based contracts with multiple payers and has built systems to manage total cost of care. Partners may believe it can be financially successful taking the same approach in Rhode Island,” according to the analysis.

“The study is also troubling because of the motivations referenced behind the acquisition of CNE by Partners,” said Fischer. In particular, the goal of driving higher profit services from Rhode Island to Massachusetts’s facilities is a real concern along with reductions in operating costs and revenue increases. All of this results in a lack of control for Rhode Island’s hospital delivery network. It is abundantly clear the real motivation by Partners is profit margin and market share.”

Richard Copp, vice president of communications at Partners, said company officials believe merging with CNE can help reduce health care costs. He said their goal is to strenghthen patient care delivery in Rhode Island.

Rob Borkowski is a PBN staff writer. Email him at Borkowski@PBN.com.