PROVIDENCE – New England collects the most property tax by a percentage of state and local taxes collected in the country, according to a report from The Tax Foundation on fiscal 2014. Rhode Island is no exception, with 44.6 percent of state and local tax revenue coming from property taxes, the third-highest share of property tax revenue in the nation (the highest percentage, 66.1 percent, is collected in New Hampshire).

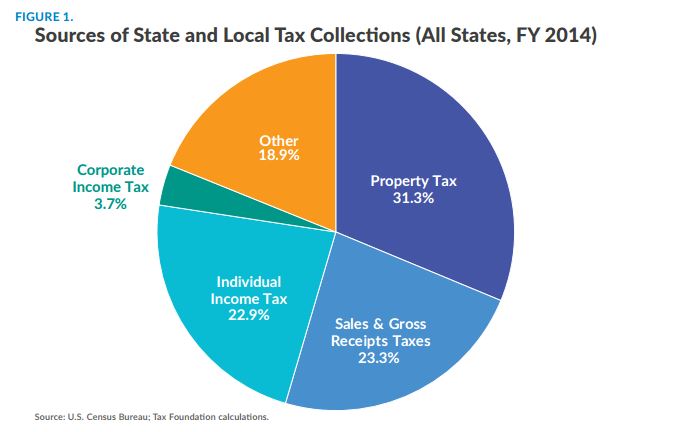

The report, which broke down tax collection by state and local jurisdictions, examined the share of property tax, sales tax, individual income tax, corporate tax and “other” tax as a percentage of all taxes collected in each state and the District of Columbia. The report also compared eight national regions to reflect tax collection trends across the nation.

The study found that the New England governments generate more revenue through property taxes – 44.6 percent of all state and local tax revenue – than any other means. And that was especially true for local governments in the region, which collected 97.2 percent of their revenue through property taxes. And while 97.7 percent of local government revenue in Rhode Island came from property taxes, and that portion ranked fifth in the nation, it was only the fourth-highest percentage in the region. Local governments in Maine received 98.8 percent of their revenue through property taxes, followed by New Hampshire (98.7 percent), Connecticut (98.5 percent) and New Jersey (98 percent). Massachusetts ranked No. 7 (at 95.7 percent), while Vermont ranked eighth (94.1 percent).

On the other hand, New England generated the lowest percentage of state and local tax revenue through sales taxes among the eight regions the study broke the United States into, with an average revenue share of 12.5 percent. The national average was 23.3 percent. Rhode Island ranked No. 37 in the nation with 16.8 percent of overall tax revenue coming from sales taxes.

Individual income taxes were the third-largest percentage of state and local revenue, according to the study, at 22.9 percent across the U.S. The Ocean State ranked No. 35, at 20 percent of state and local revenue coming from individual income taxes. New England states draw on average 20.9 percent of overall revenue from individual income tax collections.

Corporate income taxes accounted for 3.7 percent of all state and local revenue, with Rhode Island, at 2.2 percent, ranking No. 41. The six states in New England averaged 4.2 percent, the second-highest percentage in the nation.

Other taxes, which could include excise taxes on fuel, tobacco, alcohol and other products, accounted for 18.9 percent of state and local revenue. Rhode Island ranked 38th-highest at 16.4 percent, while the New England average was 17.8 percent, tied for the lowest percentage among the eight regions.

Below are rankings of specific types of tax revenue for specific governmental units, with national ranking.

State tax revenue

Property tax as a percentage of state tax revenue:

- Vermont: 2nd – 12 percent

- New Hampshire: 3rd – 16.8 percent

- Maine: 21st – 0.9 percent

- Rhode Island: 29th – 0.1 percent

- Connecticut, Massachusetts: tied for lowest in nation – 0 percent

- U.S. average: 1.6 percent

Sales tax as a percentage of state tax revenue:

- Maine: 21st – 31 percent

- Rhode Island: 22nd – 30.9 percent

- Connecticut: 34th – 25 percent

- Massachusetts: 40th – 21.9 percent

- Vermont: 45th – 12 percent

- New Hampshire: tied for lowest in nation – 0 percent

- U.S. average: 31.4 percent

Individual Income tax as a percentage of state tax revenue

- Massachusetts 4th – 52.5 percent

- Connecticut: 6th – 48.8 percent

- Maine: 21st – 36.8 percent

- Rhode Island: 22nd – 36.7 percent

- Vermont: 38th – 22.8 percent

- New Hampshire: 42nd – 4.1 percent

- U.S. Average: 35.9 percent

Corporate income tax as a percentage of state tax revenue

- New Hampshire: 1st – 23.7 percent

- Massachusetts: 6th – 8.7 percent

- Maine: 27th – 4.8 percent

- Rhode Island: 35th – 4.0 percent

- Connecticut: 37th – 3.9 percent

- Vermont: 40th – 3.6 percent

- U.S. Average: 5.4 percent

“Other” tax as a percentage of state tax revenue

This category includes, but is not limited to excise taxes on motor fuel, tobacco, alcohol.

- New Hampshire: 4th – 55.4 percent

- Vermont: 20th – 28.4 percent

- Rhode Island: 21st – 28.3 percent

- Maine: 25th – 26.6 percent

- Connecticut: 35th – 22.3 percent

- Massachusetts: 46th – 16.9 percent

- U.S. Average: 25.7 percent

Local tax revenue

Property tax as a percentage of local tax revenue

- Maine: 1st – 98.8 percent

- New Hampshire 2nd – 98.7 percent

- Connecticut: 3rd – 98.5 percent

- Rhode Island: 5th – 97.7 percent

- Massachusetts: 7th – 95.7 percent

- Vermont: 8th – 94.1 percent

- U.S Average: 72.5 percent

Sales tax as a percentage of local tax revenue

- Vermont: 35th – 2.2 percent

- Maine: 36th – 0.1 percent

- Rhode Island, Connecticut, Massachusetts and New Hampshire: Tied for lowest in nation – 0.0 percent

- U.S. Average: 12.1 percent

Individual income tax as a percentage of local tax revenue

- All six New England states had a 0.0 percent local individual income tax.

- U.S. Average: 4.8 percent

Local corporate income tax as a percentage of local tax revenue

- All six New England states had a 0.0 percent local individual income tax.

- U.S. Average: 1.3 percent

“Other” tax as a percentage of local tax revenue

This category includes, but is not limited to excise taxes on motor fuel, tobacco, alcohol.

- Massachusetts: 43rd – 4.3 percent

- Vermont: 44th – 3.7

- Rhode Island: 47th – 2.3 percent

- Connecticut: 49th – 1.5 percent

- New Hampshire: 50th– 1.3 percent

- Maine: 51st – 1.1 percent

- U.S. Average: 9.4 percent

Chris Bergenheim is the PBN web editor.