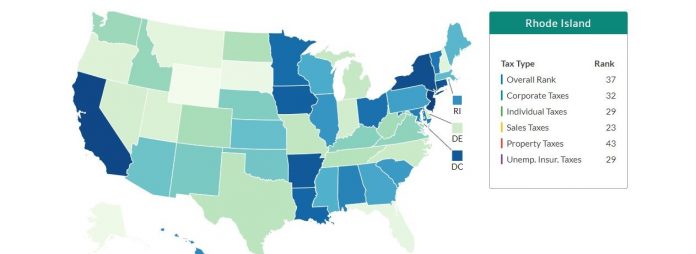

PROVIDENCE – Rhode Island ranked No. 37 on the Tax Foundation’s 2019 State Business Tax Climate Index, one spot better than its revised 2018 ranking of No. 38, the Tax Foundation announced this week.

Rhode Island ranked No. 40 in 2016 and No. 39 in 2017.

Rhode Island ranked best for its sales tax, at No. 23 in the nation, the state’s only ranking in the top half of the country, according to the 2019 index.

The nonprofit Tax Foundation ranks states with uncomplicated tax codes and lower rates higher than those with effectively higher and more-complex tax codes.

The Ocean State’s second-lowest ranking was for its unemployment insurance tax rank and its individual income tax rank, both at No. 29 in the country.

The Ocean State ranked No. 32 for its corporate taxes and No. 43 for its property taxes in the nation.

Rhode Island had the fourth-highest overall index score in New England behind New Hampshire (No. 6), Massachusetts (No. 29) and Maine (No. 30). Rhode Island ranked ahead of Vermont (No. 41) and Connecticut (No. 47).

Kentucky had the highest year-over-year ranking increase, rising 16 positions from No. 39 to No. 23. New Jersey ranked last on the 2019 State Business Tax Climate Index, while Wyoming ranked No. 1.

The methodology for calculating the index changed for the 2019 data. The changes were applied to previous years in the 2019 report.

In last year’s release for the 2018 index (before the change in methodology), the Ocean State ranked No. 41.

Chris Bergenheim is the PBN web editor. Email him at Bergenheim@PBN.com.