WASHINGTON – The nation’s real gross domestic product increased at an annual rate of 0.7 percent in the first quarter, according to final estimates released today by the U.S. Department of Commerce’s Bureau of Economic Analysis. The slowing from the fourth-quarter rate of 2.5 percent reflects an increase in imports paired with decreases in exports, federal spending and personal spending for non-durable goods, the BEA said.

The 0.7-percent first-quarter growth rate, though improved from the BEA’s estimate last month, was the slowest in four years. It also lagged the 0.8-percent median prediction from a Bloomberg News survey of 73 economists, whose estimates ranged from 0.5 percent to 1.5 percent.

The final GDP – the total goods and services produced by labor and property in the United States – is based on more complete data than was available for either the April 27 “advance” report, which estimated an annual growth rate of 1.3 percent, or the May 31 “revised” report, which estimated the GDP’s growth rate at 0.6 percent.

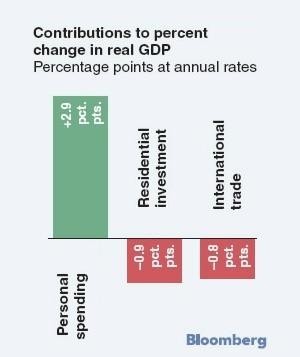

The bureau credited the GDP’s growth to increases in personal spending and spending by state and local governments, offset by reduced investment in residential fixed investment and private inventories, lower federal spending and increases in imports.

Real residential fixed investment (mostly, housing construction) fell at an annual rate of 15.8 percent in the first quarter – improving from the previous estimate’s 15.4-percent drop – after declining at rates of 19.8 percent in the fourth quarter of 2006 and 18.7 percent in the third.

Real nonresidential fixed investment increased at a 2.6-percent rate, after falling at a 3.1-percent rate in the fourth quarter; nonresidential construction increased at a rate of 4.8 percent – worsening from the previous estimate of 5.1-percent growth– after edging up at 0.8 percent in the previous quarter.

Current-dollar GDP – the market value of the nation’s goods and services output – increased 4.9 percent to $13.6 trillion, splitting the difference between the revised estimate of 4.7 percent and advance estimate of 5.3 percent. Current-dollar GDP had risen 4.1 percent in the fourth quarter.

Real personal consumption expenditures increased 4.2 percent – lagging the revised estimate of 4.4 percent – after rising 4.2 percent in the fourth and 2.8 percent in the third.

The price index for gross domestic purchases, a measure of prices paid by U.S. residents, increased 3.7 percent in the first quarter – slightly faster than the 3.6-percent rate of the previously estimates.

The price index excluding food and energy – favored by the Federal Reserve as a measure of inflation – rose at an annual rate of 2.9 percent, slightly faster than the 2.8 percent of the BEA’s previous estimate. It had risen 2.4 percent in the fourth quarter.

The BEA report also said that corporate profits from current production increased $23.0 billion in the first quarter, erasing the previous quarter’s $4.9 billion decline, while pre-tax profits grew $24.0 billion after shrinking $16.4 billion in the fourth quarter.

The report came as the Fed’s policymaking Federal Open Market Committee was convening for day two of its two-day regular meeting.

“Core inflation now is probably still running above 2 percent, going into today’s [meeting],” John Shin, an economist at Lehman Brothers Inc. in New York told Bloomberg News. “That is significant. Inflation is still above the Fed’s comfort zone.”

Still, analysts in the Bloomberg survey unanimously predicted that the FOMC will vote to hold its target for the key interbank overnight-lending rate at 5.25 percent, for its eighth consecutive meeting. The announcement is due at about 2:15 p.m.

Additional information is available at www.bea.gov.