More consumers are filing their taxes online and fewer are worried about Internet security, according to report today by The Conference Board and TNS.

In their first-quarter “Consumer Internet Barometer,” based on a survey of 10,000 online households nationwide, 39 percent of respondents expected to file their federal tax returns online, up from 28 percent three years ago.

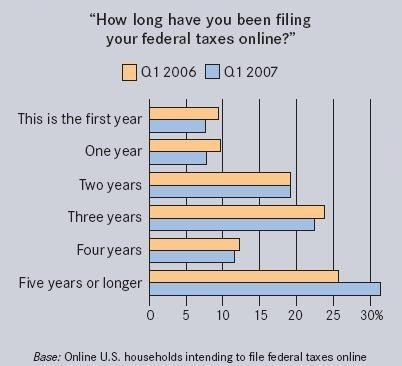

Among those planning to file online this year, nearly two thirds (67.5 percent) said they have filed their taxes online for three or more consecutive years. And among those veteran electronic filers, nearly half have been filing online for more than five years.

A professional tax service will be used by nearly 40 percent of those who plan to file their federal return online. Female filers were the most likely to rely on a service, while male filers were the most likely to rely on do-it-yourself tax software.

The number of filers using the IRS e-File service has shrunk since 2004 as eligibility has declined and alternatives have proliferated.

Security issues are less of a concern than three years ago, with only 43 percent of Internet users saying they are “extremely” concerned about filing online, down from 52 percent in 2004.

For those who don’t file online, the leading reasons were not doing their own taxes (cited by 34 percent) and concerns about personal information on the Internet (23 percent).

“Speed, convenience and choice are compelling an increasing number of consumers to toss their pencils and papers and file their federal taxes electronically,” Lynn Franco, Director of The Conference Board Consumer Research Center, said in today’s report. “Whether using professional tax services or do-it-yourself software, electronic filing continues to grow year after year. And, by far, direct deposit is the preferred refund method. This year’s ability to split refunds among up to three accounts is yet another choice that should broaden the appeal of electronic filing.”

Last year, more than 70 percent of electronic filers choose to receive their refund by direct deposit, while 18 percent request a check.

The Conference Board produces reports including the U.S. and other Consumer Confidence Index and Leading Economic Indicators. Additional information is available at www.conference-board.org and www.consumerinternetbarometer.us.