CLICK HERE. / " title="TO VIEW a full-size version of this chart, CLICK HERE. /"/>

CLICK HERE. / " title="TO VIEW a full-size version of this chart, CLICK HERE. /"/>Mortgage broker George Devine had hoped the bipartisan economic stimulus bill signed by President George W. Bush earlier this month would provide the local housing market at least a little boost.

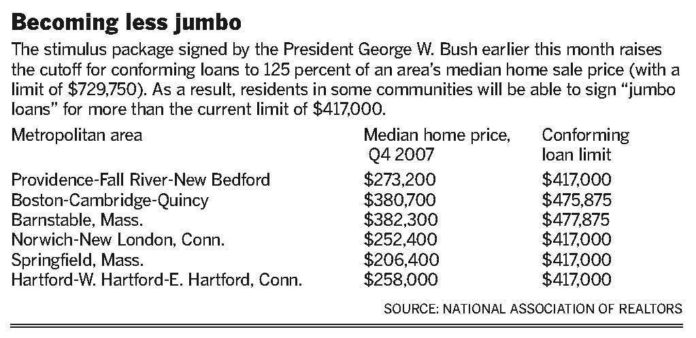

After all, part of the package was supposed to raise conforming mortgage loan limits above $417,000, meaning fewer people would be forced to seek so-called jumbo loans above that limit and pay higher interest rates.

Although the details have yet to be worked out, it appears the guidelines laid out in the stimulus package will not change the conforming loan limit, at least not in the Rhode Island market.

“It’s a big disappointment to us,” said Devine, president of Landmark Mortgage Lenders Corp. in Providence. “This really would have helped us to be able to fit people into mortgages with lower rates.”

The new guidelines, which are set to last only until the end of the year, allow federally chartered mortgage finance giants Fannie Mae and Freddie Mac to buy home loans worth up to 125 percent of an area’s median home price – to a maximum of $729,750. Using preliminary numbers, here are some rough calculations:

The median home price for the fourth quarter of 2007 in the Providence-Fall River-New Bedford market was $273,200, according to figures from the National Association of Realtors. Because 125 percent of that median price is $341,500, it appears the existing $417,000 threshold will remain in effect in the Rhode Island area.

The guideline changes do provide relief for many homeowners in places such as Southern California, where property values are generally higher and a greater percentage of borrowers hold high-rate jumbo loans or need one to buy a home.

The median home price in the Los Angeles-Long Beach-Santa Ana market, for instance, was $509,700 for the fourth quarter of 2007, according to National Association of Realtors. If that number were to be used to make the official calculations, the conforming limits in that market would be boosted to $637,125.

Conforming loans are considered much less risky to investors than jumbo loans because conforming loans can be bought by Fannie Mae and Freddie Mac and repackaged as securities with an implied government guarantee. For that reason, jumbo loans typically feature high interest rates, which have only gotten higher in the wake of the subprime meltdown.

Right now, Devine said, the interest rate for a 30-year, fixed-rate mortgage in the area is hovering around 6.25 percent, while the jumbo rate is about 7 percent.

The stimulus package also temporarily changes the ceiling nationwide for Federal Housing Administration loans, which feature less-stringent lending guidelines for potential homebuyers. Like the changing conforming loan limits, the new FHA ceiling will be set at 125 percent of the median price in an area.

Locally, the largest amount allowed for FHA loans is currently $316,350, but it appears the new guidelines will lift that ceiling. If the numbers were to be based on the fourth quarter median home price from the National Association of Realtors, the FHA lending ceiling would rise to $341,500.

Doug Brown, retail sales manager at Mortgage Amenities Corp. in Lincoln, said it’s unclear how many borrowers will be able to take advantage of the new ceilings. About 75 to 90 percent of Mortgage Amenities’ customers seek FHA-backed loans.

“Anything will help,” Brown added.

Nevertheless, Brown said the government still needs to hammer out the details of the stimulus package, so he doesn’t expect to see any changes at least until May.

At Landmark Mortgage, where 25 percent of the business has been jumbo loans, Devine said raising the conforming loan limit in Rhode Island – while not having a direct effect on the majority of borrowers – would have helped just the same.

On a $450,000 loan, the difference between conforming-loan and jumbo-loan interest rates could mean a $225 difference in a homeowner’s monthly mortgage payments, Devine said.

Devine figured a hike in the loan limit would have made homes priced in the $500,000 to $800,000 range more attractive to buyers. Additionally, Landmark Mortgage is brokering loans for a high-end waterfront condo complex in the southern part of Rhode Island. “We were really looking forward for this helping out on that project as well,” he said.

“On the surface, you might say it was going to help only those privileged markets, but there’s a whole ladder effect here,” added Devine. “There might be people looking to sell their less-expensive house and move up to that jumbo price range, too.” •