PROVIDENCE – Expect a “painfully slow” recovery to the economy in Rhode Island, wrote Leonard Lardaro, an economist at the University of Rhode Island in the state’s monthly Current Conditions Index report for September.

“Most people will probably remain unconvinced that a recovery is actually occurring,” wrote Lardaro in the CCI report, which was released Monday.

Lardaro was firm in his sentiments that an economic recovery in the state will take three to five years, but it does not mean that the state will return to the levels of activity that existed prior to the coronavirus in March, often nicknamed as “normal times.” Instead, he said it will take a sustained period of increasing overall economic activity.

The pace will be slow, and he wrote that the state’s government never adequately adapted to the realities of managing a post-manufacturing economy, where economic growth must be “continually earned based on informed and proactive policy.”

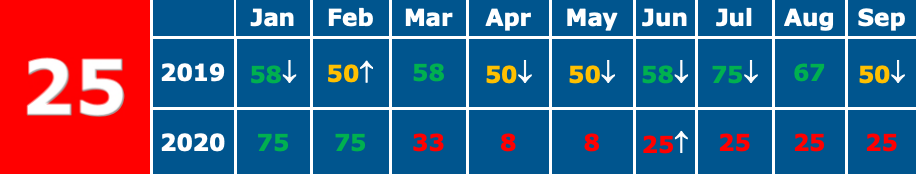

The CCI for September was 25, which is a dip of 50 from September of 2019, but is the same score for the fourth consecutive month this year. Only three out of the 12 CCI indicators improved year-over-year in September, including retail sales, manufacturing wages and the labor force.

A CCI value above 50 indicates expansion, while a value below 50 indicates contraction.

However, for the last few months, Lardaro has analyzed the monthly changes as the state reopens the economy and students return to school, to measure the likelihood of experiencing a recovery effort. If tracking monthly changes, the CCI rose to an expansion level of 67, which Lardaro said is the first such value since the pandemic began.

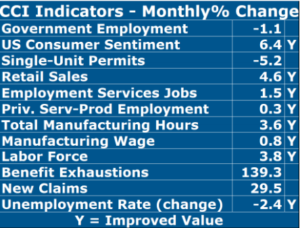

Of the 12 CCI indicators, eight improved month-over-month, including U.S. consumer sentiment, retail sales, employment services jobs, private service-production employment, total manufacturing hours, the manufacturing wage, labor force and the unemployment rate.

“We will need to sustain such above-50 values for a recovery to begin,” said Lardaro. “Unfortunately, the primary factors determining the likelihood of this are beyond Rhode Island’s direct control.”

He said unlike cyclical recessions, the state won’t need to rely primarily on improving financial conditions, but instead, he wrote that everything hinges on COVID-19 containment, an effective vaccine, fiscal and monetary policy.

“My worry is that two key non-survey based CCI indicators are moving in the wrong direction: Both benefit exhaustions, which reflects long-term unemployment and New Claims, the best measure of layoffs, have begun to oncer again move higher,” Lardaro wrote.

Year-over-year changes in Rhode Island’s CCI indicators:

- Government employment declined 2.3%

- U.S. consumer sentiment declined 13.9%

- Single-unit permits increased 14.5%

- Retail sales increased 6.8%

- Employment services jobs declined 29.3%

- Private service-production employment declined 8.3%

- Total manufacturing hours declined 2.6%

- The manufacturing wage increased 4.5%

- The labor force increased 0.8%

- Benefit exhaustions increased 1,974%

- New claims increased 546.6%

- The unemployment rate increased 7.0 percentage points

Alexa Gagosz is a PBN staff writer. Contact her at Gagosz@PBN.com. You may also follow her on Twitter at @AlexaGagosz.