PROVIDENCE – In the second quarter of 2017, 27,677 properties in the Providence metropolitan area were saddled with negative equity mortgages, comprising 7.5 percent of all mortgage holders in the area, according to a report issued by CoreLogic Inc. Thursday.

Negative equity mortgages, or underwater mortgages, in the Providence metro area declined 2.6 percentage points (or 24.6 percent) year over year. In the second quarter of 2016, the metro area had 36,699 underwater mortgages.

A mortgage becomes an underwater loan when the value of the home is less than the value of the loans taken out against the home (this could include the mortgage used to purchase the home as well as subsequent home equity loans).

In addition to the 27,677 underwater mortgages in the Providence metro area, 6,413 properties, 1.8 percent of all mortgages in the area, were in near-negative equity (less than 5 percent equity) for the second quarter of 2017. The share of near-negative equity properties in the metro area declined 0.5 percentage points (or 21.4 percent) year over year.

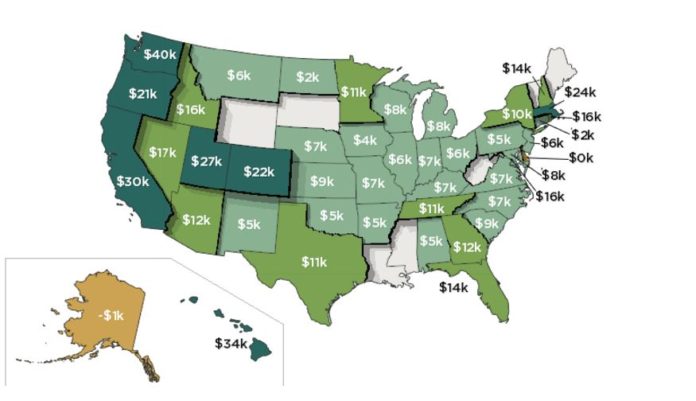

In Rhode Island, the share of underwater mortgages was 8.6 percent in the second quarter of 2017. Mortgage holders experienced an increase of equity in their homes of $15,536 year over year.

Nationally, 5.4 percent of all mortgaged homes are underwater. Homeowners with mortgages in the United States gained $12,987 in equity year over year in the second quarter of 2017.

Chris Bergenheim is the PBN web editor.