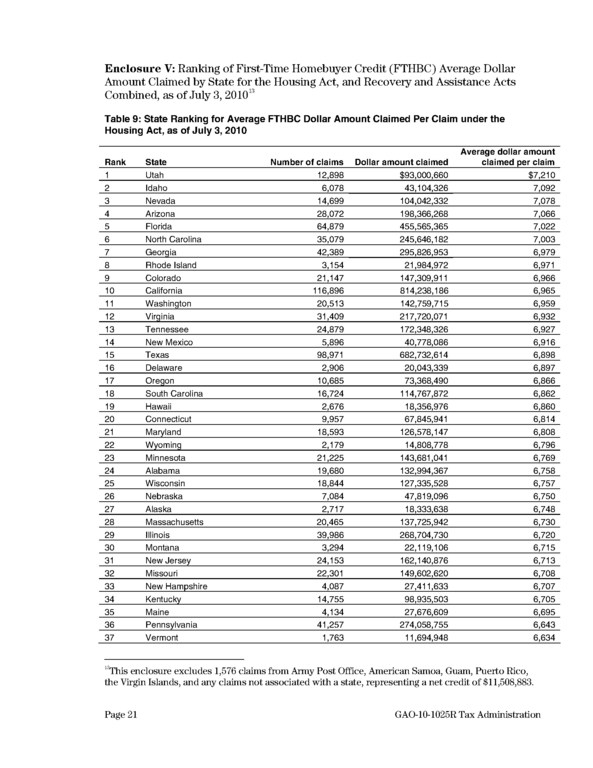

CLICK HERE. / " title="RHODE ISLAND RANKED 8th nationally for the average dollar amount claimed by the states under the Housing, Recovery and Assistance Acts combined. The Ocean State observed an average of $6,971 per claim, according to data released by the U.S. GAO on Sept. 2. For a larger version of this chart, CLICK HERE. /"/>

CLICK HERE. / " title="RHODE ISLAND RANKED 8th nationally for the average dollar amount claimed by the states under the Housing, Recovery and Assistance Acts combined. The Ocean State observed an average of $6,971 per claim, according to data released by the U.S. GAO on Sept. 2. For a larger version of this chart, CLICK HERE. /"/>PROVIDENCE – Rhode Islanders claimed $21,984,972 in federal homebuyer tax credits as of July 3 through the three versions of the program – Housing Act, Recovery Act and Assistance Act – according to data released by the U.S. Government Accountability Office on Sept. 2.

Massachusetts reported $137.7 million in credits through 20,465 claims for the same time period.

The report studies the financial repercussions of the First-Time Homebuyer Credit program that Congress passed since its inception in 2008. The Joint Committee on Taxation estimates that the three FTHBC provisions combined may result in total revenue losses to the federal government of about $22 billion through 2019.

The three FTHBC credits include: the Housing and Economic Recovery Act of 2008, the American Recovery and Reinvestment Act of 2009 and the Worker, Homeownership, and Business Assistance Act of 2009.

Rhode Island ranked 8th nationally for the average dollar amount claimed by the states under the Housing, Recovery and Assistance Acts combined. The Ocean State observed an average of $6,971 per claim. Massachusetts came in at No. 28 with $6,730 average dollar amount per claim.

The GAO found that nationally about 1 million claimants took advantage of the Housing Act to take out $7.3 billion in tax credits that must be repaid starting in January 2011.

Under the Recovery Act and Assistance Act provisions, 2.3 million claimants reported a total of $16.2 billion in tax credits (that must not be repaid).

In the national ranking, California ranked No. 1 for FTHBC dollars claimed under the Housing Act provision as well as under the combined provisions of the Recovery and Assistance Acts.