A key part of the proposed agreement between the state and 38 Studios LLC to bring the video game company to Rhode Island involves financial penalties the firm would face for not making good on its promise to bring several hundred high-wage jobs to the state.

The penalties are called for under the recently enacted $125 million Job Creation Guaranty Program, though the legislation leaves the details to the R.I. Economic Development Corporation to hammer out.

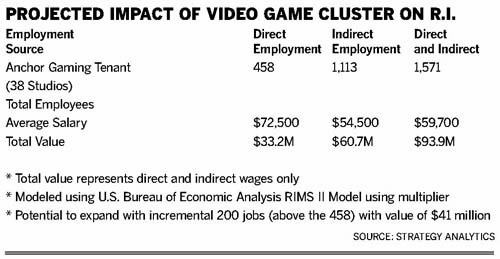

The EDC has reached a preliminary agreement with the venture founded by former Boston Red Sox star Curt Schilling that would have the state guarantee a $75 million loan to the company under the newly created program. The company would relocate from Maynard, Mass., and Baltimore, bringing 458 new jobs to the state by 2012, paying an average annual salary of $72,500. The firm’s move also would lead to the creation of a video game cluster of businesses in Providence that would bring additional jobs to a state now mired in double-digit unemployment, according to its proposal to the EDC.

EDC staff and consultants the department hired are now performing due diligence to review the pros and cons of the preliminary agreement, with no time frame set on when a final recommendation will be ready for the EDC board, Executive Director Keith W. Stokes has said.

Stokes and House Finance Committee Chairman Steven M. Costantino, main sponsor of the House legislation creating the loan-guarantee program, recently spoke to Providence Business News about the new law and what would happen should a company like Schilling’s fail to make good on its promises.

Costantino said the new law addresses the question with this sentence: “The documentation reflecting guaranty and bond obligations authorized hereby shall contain adequate legal provisions for assuring performance by the borrower of creating and retaining new jobs within this state.”

This documentation, according to Costantino and Stokes, would include terms of the loan along with details on what the collateral would be and “performance standards” that the company would be required to meet. Those standards would include the creation and retention of a certain number of jobs with “penalty payments” for failure to comply, Stokes said.

Asked what kind of penalties might be assessed, Stokes confirmed that they would be monetary, with the specifics dependent on the terms of the loan agreement and the nature of the company involved. The penalty fees would be paid to the EDC, he said.

Collateral for a new firm that owns no real estate and has yet to create a product can be problematic. In a case such as 38 Studios, Stokes said he would expect that the collateral would be in the form of soft assets, such as the rights to a patent that would eventually generate revenue.

It was unclear last week if the idea of penalizing companies that do not live up to state agreements is a policy that the EDC will implement on a wholesale basis, or how often such an approach has been used in the past.

Melissa Chambers, EDC spokeswoman, said other EDC programs do leverage monetary penalties when companies do not meet the required job thresholds outlined in term sheets and contracts. Chambers did not, however, identify specific examples of companies that have been fined.

Since news broke about the $125 million state loan guaranty program, Stokes said he has heard from two companies in the knowledge-and-technology industry interested in it. He declined to identify the firms, but was clearly excited by the interest the new law is generating in economic-development circles.

“We’re on the map,” he told PBN in a recent interview. “Curt Schilling and others have been calling me and saying, ‘We saw that you [the state] reduced your personal income tax, you have a regulatory-reform program, you have an EDC that is now business-friendly.’ I’ve had a number of different inquiries from existing companies and those outside calling me and saying that it looks like Rhode Island is heading in the right direction.”

“Curt Schilling has assembled probably one of the finest gaming-industry teams in the marketplace, a very stellar group,” Stokes said, referring to comic book and toy creator Todd McFarlane and fantasy author R.A. Salvatore. Also, 38 Studios acquired the Big Huge Games company in 2009.

According to the information 38 Studios presented to the EDC at a June board meeting, Schilling and his partners are looking to form a video game cluster of companies based in Providence. Such a cluster could also include, for instance, Hasbro Inc., the Rhode Island School of Design and even participation by the U.S. Naval War College in Newport which, Stokes said, has the largest gaming-simulation apparatus in New England.

Plans call for the EDC to issue $75 million in revenue bonds, which would be purchased by a group of investors led by Wells Fargo. Schilling’s company would be responsible for paying back Wells Fargo, with the state acting as guarantor in the event of default.

Stokes has said the 38 Studios proposal is being reviewed to make certain that: 38 Studios can pay back the loan even if its video games do not sell; high-paying jobs are created; and similar companies would be drawn to Rhode Island to become part of the Providence cluster. •

No posts to display

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.