NEW YORK – As Congress wrangles over how to gut Obamacare in the coming years, a move threatened by the Trump administration could weaken the program in just weeks – by cutting health-care subsidies for the poor, which could cause thousands to lose coverage.

President Donald Trump and his administration have said they may stop paying subsidies worth about $7 billion a year that are used to help low-income people in Obamacare with co-pays and other out-of-pocket costs. While passage of a GOP repeal bill Thursday may postpone immediate action, ending the subsidies would mean hundreds or thousands of dollars a year in extra expenses that those people can’t afford.

“The consequences for people who buy insurance in the exchanges cannot be understated,” said Chip Kahn, president of the Federation of American Hospitals, an industry lobbying group, in a blog post. “Consumers face two possible outcomes – insurers will either leave the marketplace or be forced to raise their rates.”

Health insurers face an increasingly uncertain future in the Affordable Care Act. Aetna Inc. and Medica Holding Co. announced this week that they’re pulling out of marketplaces in Virginia and Iowa, respectively, while Molina Healthcare Inc., one of the last big for-profit participants, has said it may leave the program. Anthem Inc., the biggest for-profit company participating widely in the program, has said it may pull out as well. Stopping the subsidies would throw their business under the law into chaos at a time when they’re already struggling to figure out their place.

For more politics coverage, subscribe to the Bloomberg Politics Balance of Power newsletter

Ongoing Threat

The House voted Thursday to pass a bill that would repeal much of Obamacare, though lawmakers in the Senate have said they plan to start over with their own legislation. Trump has said he might move to cut the subsidies, which would further destabilize the ACA insurance market, to force Democrats to work with him if the bill didn’t move ahead. While Thursday’s vote may lift the threat for now, insurers including Molina, Anthem and Aetna have said the uncertainty around Obamacare may cause them to drop out.

Anthem Chief Executive Officer Joseph Swedish said last month that the insurer was “assessing our market footprint in 2018,” and would sharply raise rates if the subsidies, known as cost-sharing reduction payments, or CSRs, aren’t paid.

Health insurers have gained since Trump’s election, partly on the prospect of looser regulations on the industry. Many publicly traded insurers have largely pulled back from the law, limiting their exposure. Hospitals have performed less well, though shares of both groups closed slightly up Thursday after the House vote. There’s also an expectation that the House bill, which would gut large parts of the Affordable Care Act and is projected to cause millions of people to lose coverage, will be substantially rewritten.

“People do think it’ll get watered down in the Senate,” Ana Gupte, an analyst at Leerink Partners, said Thursday.

Bargaining Chip

Trump has repeatedly targeted the subsidies, once saying that he’d give them as much funding as Congress provides for a border wall with Mexico, one of his preferred projects. After congressional Democrats thought they had assurances the subsidy program would remain, Trump called it a “bail out” for insurers, and Office of Management and Budget Director Mick Mulvaney said the administration has “not made any decisions” whether to fund the payments beyond this month.

“Signals like this say even if they make a commitment one day, it could change the next day,” said Jack Hoadley, a professor at Georgetown University’s Health Policy Institute in Washington. “This could be the last straw.”

The debate over the CSRs stems from a lawsuit GOP House members filed in 2014 charging that the Obama administration inappropriately funded the payments on its own, rather than going through Congress. House Speaker Paul Ryan refused to include funds for the payments in a spending measure the House passed Wednesday.

Widespread Dependence

Under their contract with the U.S. government, insurers can legally pull out of federally run exchanges if the cost-sharing payments aren’t made, said Maryland Insurance Commissioner Al Redmer. In states where insurers operate their own exchanges, the contracts vary, said Redmer, who is also chair of the National Association of Insurance Commissioners’ health insurance and managed care committee.

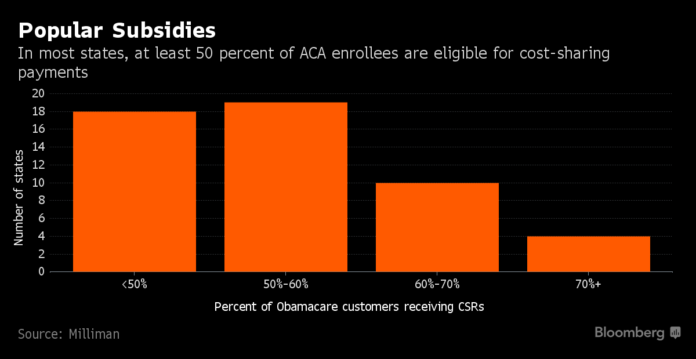

Dependence on the subsidies varies widely among states, ranging from 16 percent of Obamacare customers in Minnesota to 78 percent in Mississippi, according to a report from consulting firm Milliman.

Only plans sold on the exchanges are eligible for the assistance payments. While exiting the exchanges mid-year wouldn’t cancel coverage, customers would no longer qualify for premium subsidies, which might lead to the same outcome, Redmer said in an email.

“If a consumer can’t or won’t pay the full amount on their own, the plan could be canceled according to state law – typically after 30-60 days,” he said.

Impact Substantial

Insurance executives must decide in June whether they’ll raise premiums in 2018 or whether they’ll participate in the Obamacare marketplaces at all. The CSR payments are key to those determinations.

“Unless there are assurances around 2018, the price impacts are substantial – it’s billions of dollars across the industry,” Aetna CEO Mark Bertolini said Tuesday.

Anthem’s preliminary 2018 rates reflect the assumption that the cost-sharing payments will be funded, Swedish said last week. If they aren’t, all bets are off.

“We are notifying to our states that, if we do not have certainty that CSRs will be funded for 2018 by early June, we will need to evaluate appropriate adjustments,” Swedish said on a conference call with investors.

Without the subsidies, the insurer could raise premium rates 20 percent or more, or drop coverage in certain areas, Swedish said. Assistance with insurance premiums is provided under a separate program, so such rate increases would actually end up costing the federal government more.

If the CSRs are eliminated, the federal government could pay $12.3 billion more in premium subsidies, assuming insurers stay in the Obamacare market, according to the Kaiser Family Foundation.

“That’s the irony of the whole thing,” Fritz Busch, a consulting actuary with Milliman, said.

Anna Edney is a reporter for Bloomberg News.