TPI Composites has had a very busy April.

The Warren-based manufacturer of large-scale composite structures such as blades for wind turbines, hoods for military vehicles and composite buses this month announced two major expansions to its wind energy business.

One expansion will triple the capacity of TPI’s wind blade manufacturing operation in Juarez, Mexico. The other is not an expansion of an existing structure, but the construction of a new 190,000-square-foot facility in China that will manufacture blades for GE Energy, with which TPI recently signed a long-term supply agreement.

These expansions will result in the addition of about 850 employees – 400 in Mexico and 450 in China – over the next 12 months.

But Steven Lockard, president and CEO of TPI Composites, said that though the company is expanding its operations in Mexico and adding a new facility in China, it has not forgotten about the capabilities of its Rhode Island facility, which employs 100 people.

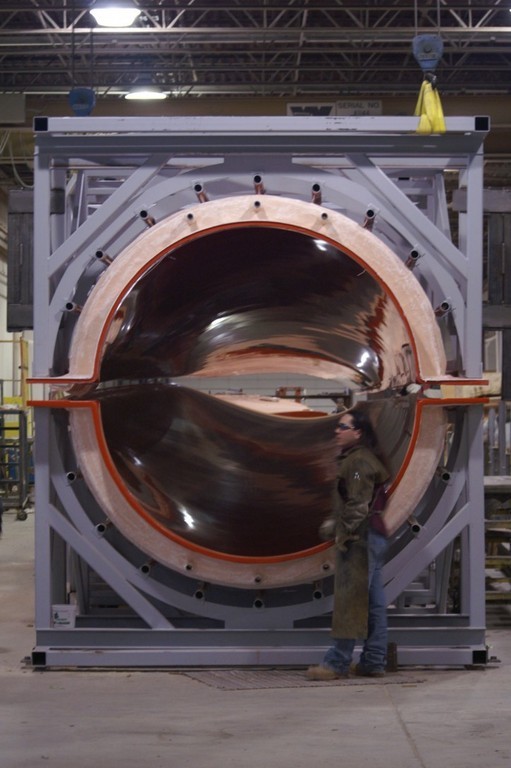

The company has increased its Rhode Island work force from 75 to 100 over the past year to support its offshore expansions because, in addition to housing much of the company’s administrative and research and design personnel, the Rhode Island facility houses the manufacturing of much of the company’s molds and tooling for products made offshore.

“We are continuing to look for business to support our operations in Rhode Island,” Lockard said.

And with state-led initiatives such as RIWINDS, which would make wind-powered generation cover 15 percent of the state’s aggregate electrical demand, and wind power projects off Cape Cod and the Delaware coast, Lockard said, he thinks there is a possibility that TPI could one day manufacture blades in Rhode Island.

“As those projects become real … it would be cost-efficient to manufacture in Rhode Island,” he said. “We have a core manufacturing capability here. … Once we have an installed base, it’s easier to expand that base than build new.”

Those words are like music to Andy Dzykewicz, director of the R.I. Office of Energy Resources. “This is actually something we’ve been hoping for,” he said.

Dzykewicz said if getting 15 percent of the state’s power from wind is a home run, then getting TPI to manufacture blades in Rhode Island and another company to manufacture the parts of the turbines in Rhode Island would be a grand slam.

The state would be the perfect hub for manufacturing the blades and turbines, he said, because of its central location in the Northeast and its ample access to the ocean for shipping parts to wind farms across the region.

And the number of jobs this industry would create could be in the thousands, he said.

While waiting for the Northeast to catch up, TPI will continue to ride the success of its wind energy business in other places. Deals such as the supply agreement with GE Energy are crucial to that end.

“The growth of our company is attached to these long-term agreements with major players in the industry,” Lockard said. “A lot of our strength comes from the long-term relationships we’re creating.”

Wind power generating capacity in the United State increased 27 percent in 2006 and is expected to increase another 26 percent this year, according to a market forecast released by the American Wind Energy Association.

The forecast also stated that the U.S. wind energy industry invested about $4 billion in the installation of 2,454 megawatts of new wind-power generating capacity last year. That makes wind one of the largest sources of new power generation in the country.

And TPI is boosting its competitive edge in the industry by “being willing to build a factory in Mexico and China in order to optimize transportation and labor costs,” which makes the product cost efficient for customers in the areas those factories serve, Lockard said.

The manufacturing plant in China, for example, will serve the wind energy industry in Asia, he said. And the expansion of the plant in Mexico is testament to the increased demand for blades in the Western United States.

“The industry is expanding at terrific rates,” he said, adding that the company’s wind-energy sector now makes up more than half of its total business. Lockard said he expects it to continue to be more than half of the company’s business in the future.