After decades as a division of publicly traded Fortune Brands, Acushnet Co. was sold to a consortium of Korean investors led by Fila Korea Ltd. and Mirae Asset Private Equity for $1.22 billion in a deal that closed at the end of July.

Longtime CEO Wally Uihlein has overseen the golf equipment and apparel company’s global expansion in terms of both sales and manufacturing, and talks about why that expansion has happened and what it means for the company’s southeastern Massachusetts operations.

PBN: Will being privately held change the way you run Acushnet Co.?

UIHLEIN: When you are part of a publicly traded ongoing concern, you are at the mercy of the quarter-to-quarter expectation. … The fact is, being that exposed to the mercurial nature of Wall Street forces you to do the best you can to both provide a trajectory and manage your trajectory. And I think in a privately held situation, first of all, you don’t have some of the costs you had being publicly traded, because there are certain reports you have to file and other administrative obligations you don’t have. [And] you can take steps and make investments that are long-term consequential but they may result in a short-term, bad quarter-to-quarter comp.

PBN: Do you feel like the new ownership group gives you new energy as well as new capital?

UIHLEIN: I think three things.

One, the geographical nexus of their location just helps us not having to explain why we may need to make investments in emerging markets or in growing markets, like Asia-Pacific. … You need to [create] infrastructure accordingly in a differentiated mode. So if you’ve never been there, you’re kind of like, well, what are you doing and why are you doing it?

Point two, cost of capital is less over there. That has to do with the global economy. Countries that have surplus cash, the cost of capital is less compared to countries that don’t have surplus cash. You’re in a part of the world where they’ve got surplus cash, they’re looking to make investments. [And] if you are going to have a house bought for you, and then you are going to be expected to make the principal and interest payments, you’d rather have that transaction conducted at a lower interest rate. …

PBN: And that translates into more stability here in southeastern Massachusetts?

UIHLEIN: That’s exactly right. The key is, if you want to stabilize things in the West, grow in the East. That’s our mantra – defend the West, grow the East.

PBN: The difference between the two markets is not just how people spend money. Physically, there are differences.

UIHLEIN: There are physiological differences country to country. For golf, the diagnostic revolves around the launch condition [of each golfer]. It’s important to know [how a player strikes the ball] and then design your products accordingly.

But we also think what is important to note is that part of the world is more willing to pay the premium price for the use of an expensive chassis and/or components on the club side in order to get optimal performance. Because in that part of the world, because of the economics, there are premium and super-premium price points, where you might not see that in the United States. I think it’s an interesting commentary when you look at the worldwide automotive market and how many luxury sedans are sold in Asia-Pacific versus how many luxury sedans are sold in the West. When you go and do that analysis and see that it’s probably three to one or four to one, that gets your attention. And … that’s true of any hard-goods product category.

UIHLEIN: Yeah, we actually already have geographical-specific product, VG3 product for the Japan market … both balls and clubs. So we will continue to look at market-responsive designs and have the luxury of having the price-point flexibility to design and make the product not governed and hands tied by what the market will bear price-wise. I think that’s really an untapped upside opportunity.

PBN: The new chairman of the company said that you were not going to change anything in terms of employment here into the foreseeable future.

UIHLEIN: We always have to remember that supply chain management is a byproduct of where sales are. It starts with where sales are and then, certainly, it’s prompted by where can you make stuff cost competitively. That’s a large part of the reason we built Ball Plant IV in Thailand, to service the Asia-Pacific region, which I indicated is already 25 percent of the world’s total.

Golf balls are heavy, and when you ship them from New Bedford to ports of call 8,000 miles away, by the time they get there, they’re a lot more expensive than when they left. So I think what’s important in answering that question is to take a step back and say, OK, where is stuff wanted? Where is the global demand curve geographically and then [design] your supply chain. •INTERVIEW

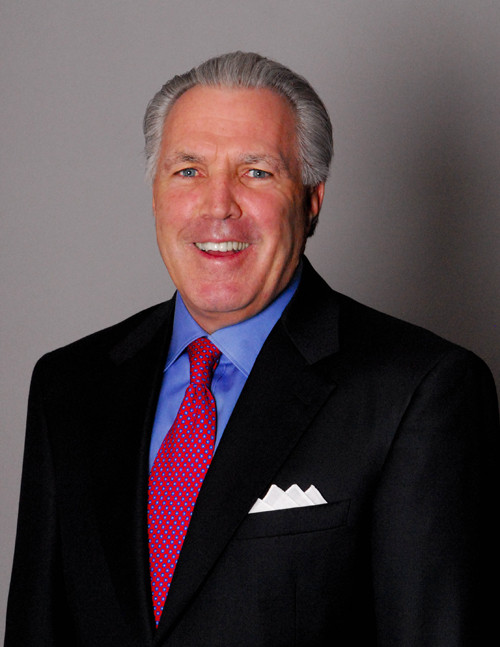

Wally Uihlein

POSITION: CEO, Acushnet Co.

BACKGROUND: Uihlein started as a sales representative for Titleist in 1977, rising to regional sales manager in less than a year, to national sales manager within a year and general sales manager within another year. After a number of other promotions, he was made vice president and general manager of Titleist in 1985. In 2000, he was made president and CEO of parent The Acushnet Co.

EDUCATION: Attended the University of Massachusetts Amherst and completed graduate business management coursework at Suffolk University in Boston.

FIRST JOB: As a sixth-grader, Uihlein worked in the golf shop at a nine-hole golf course in Bradford, Mass.

RESIDENCE: Mattapoisett, Mass.

AGE: 61