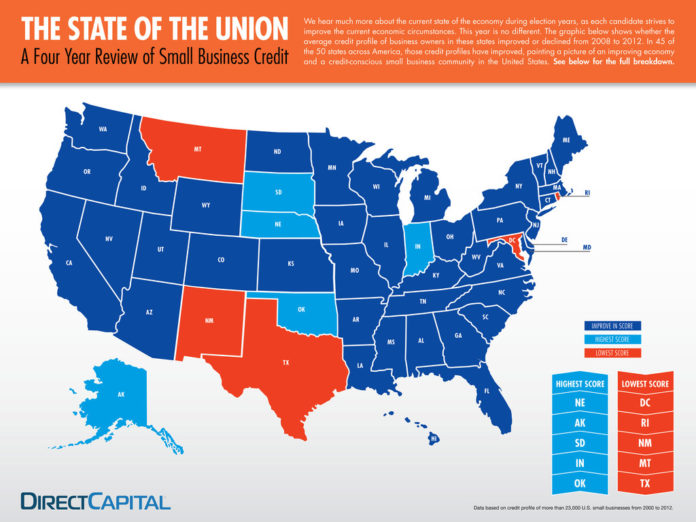

PORTSMOUTH, N.H. – During the last four years, the average credit profile of U.S. small business owners has improved in 45 of 50 states and the District of Columbia, but not Rhode Island, according to a report by Direct Capital Corporation.

Direct Capital, a nationwide lender to small businesses, reviewed credit data on more than 23,000 small businesses over the past 12 years. During the last four years, the study showed that the average credit profile for small business owners improved for most states in the country.

Washington, D.C., registered the lowest average credit profile, followed closely in order by Rhode Island, New Mexico, Montana and Texas, which rounded out the bottom five.

Conversely, Nebraska business owners had the strongest average credit profile in the country, followed in order by Alaska, South Dakota, Indiana and Oklahoma.

“Business owners today are much more aware of how important it is to maintain a strong credit profile, and that is reflected in the data,” Direct Capital Vice President of Marketing Stephen Lankler said in a statement. “That was not the case five to seven years ago, when it was much easier for a business to access credit.”

According to Lankler, the recession, coupled with an increase in products allowing people access to their credit profiles, played significant roles in this heightened awareness.

“As a result of the financial crisis, major lenders – including banks – have become much more restrictive in extending credit to business owners,” said Lankler. “In response, business owners have become more vigilant in maintaining strong credit profiles, and a flood of products have been introduced to help them do so.”

The Direct Capital report did not list specific credit profile data for each state.