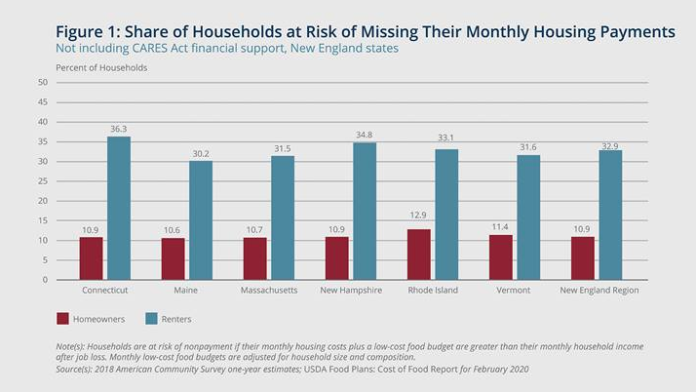

PROVIDENCE – A new report from the Federal Reserve Bank of Boston found that without the intervention of the Coronavirus Aid, Relief, and Economic Security Act, 12.9% of homeowners in Rhode Island were at risk of missing their monthly housing payments, higher than the New England rate of 10.9%.

The report measured at-risk jobs, the share of homeowners with a mortgage, and food costs. The initial figures in the report did not include the lump sum payment included in the CARES Act or the adjunct Unemployment Insurance payments backed by the federal government. The study also did not include expenses related to health care, utilities or debt payments.

The Fed’s study also found that more than one-third of renters (33.1%) in the state were at risk of missing a housing payment prior to federal assistance, just higher than the New England rate of 32.9%.

The report said that a total of about $1.43 billion in rents and mortgages were at risk of nonpayment every month in New England due to coronavirus-related job losses, with just over one-half attributable to missed rent payments. The Fed found that the problem could have a feedback loop as well, with renters missing payments causing homeowners to miss mortgage payments. In Rhode Island, the figures were $48 million in at-risk mortgage payments and $49 million in at-risk rent payments.

When including the lump sum payment from the CARES Act, as well as augmented weekly unemployment benefits, the impact in the region was significantly improved.

With the CARES Act benefits, mortgage payments at risk in Rhode Island ranged between $7.4 million and $14.2 million, depending on unemployment insurance benefit participation. The figures represent between 4,469 and 9,265 homeowners.

The amount of unpaid rent at risk with the CARES Act benefits ranged between $13.7 million and $19.6 million, representing between 12,492 and 18,869 renters. The figures represent 75% UI benefit participation and 95% UI benefit participation, respectively.

“Restricting broad swaths of economic activity is the public health action required to prevent further spread of COVID-19, but the restrictions have additional consequences that are important to recognize,” the report said. “The federal policy response has likely averted an immediate financial disaster for households. The state-level responses have helped guarantee that those who fall through the cracks can remain in their homes, at least in the short term. Every New England state has responded with a moratorium on evictions. … However, these measures do not prevent households from continuing to miss housing payments entirely.”

The report noted that the effects on the housing market will be unavoidable, with massive impacts in even best-case scenarios.

The report concluded: “Addressing these secondary impacts of the pandemic crisis could become more important as the immediate effects are resolved. The missed mortgage and rent payments that will likely accrue have the potential to create a burden on the broader housing market.”