PROVIDENCE – Citizens Bank ranked last in a new J.D. Power study examining the quality of retail banking advice at major U.S. banks.

The inaugural study, dubbed “2018 U.S. Retail Banking Advice Survey,” surveyed 3,841 retail bank customers of 17 large U.S. banks who received any guidance from their primary bank regarding relevant products and services or other financial needs during the past year.

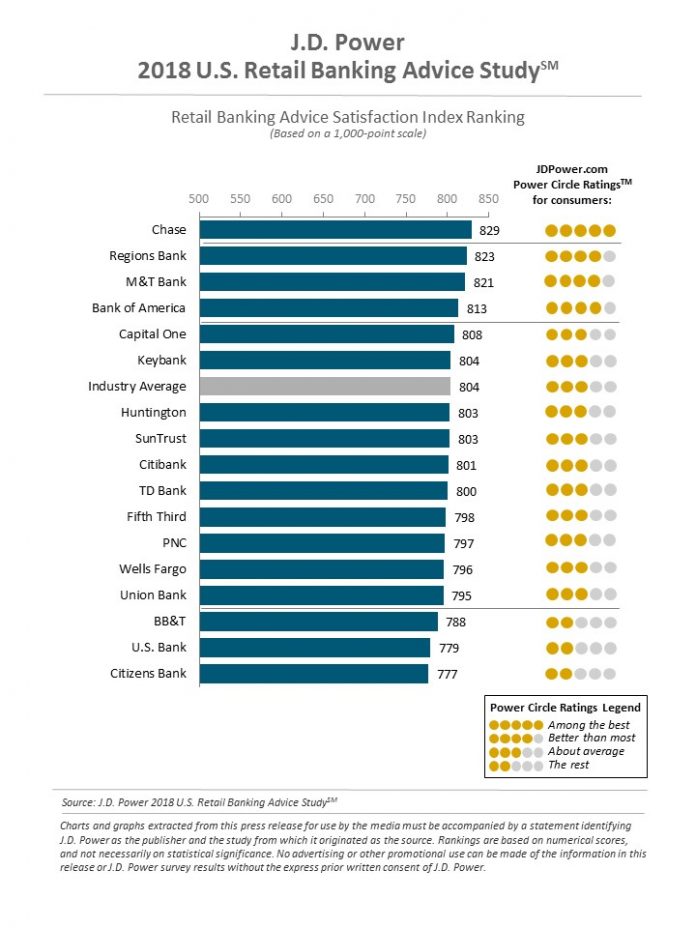

Providence-based Citizens Bank earned a score of 777 out of 1,000, representing the worst score among all banks surveyed. It was the only Rhode Island-based bank included in the study.

In a response to the survey, Citizens spokeswoman Megan M. Griffin wrote an email underscoring various new products and services the bank has launched and suggested the bank measures success using a wider range of metrics.

“Outside rankings provide a view into how we’re performing, but we look at these in combination with other data to get a more holistic picture of our customers’ experiences and expectations,” she wrote.

J.D. Power, a global market-research company, launched the inaugural report because it wanted to examine how well retail banks are connecting with customers.

“The challenge for banks is getting the advice formula right and delivering it in a personalized manner across all channels – not only at the branch, but also via the website and mobile app,” said Paul McAdam, senior director of the banking practice at J.D. Power.

The survey found 78 percent of retail bank customers want guidance. Among those who received it, 89 percent said they benefited from the information. But only 28 percent of respondents can recall recently receiving any type of financial advice. There also appears to be a disconnect between those receiving advice and those using digital services, posing its own challenges as banks become ever-more digital.

J.D. Power found a direct correlation between customer advice satisfaction and their level of trust in the financial institutions.

“For banks, the key takeaway from this study is that there is a huge opportunity to leverage a combination of in-person and digital interactions to provide advice and guidance that assist customers in their financial journey,” McAdams added.

Citizens Bank, a subsidiary of Citizens Financial Group Inc., was among four banks to earn a lower score than Wells Fargo, the San Francisco-based bank that’s been ensnarled in a retail banking scandal for deceiving customers and opening fake accounts in their names.

Chase Bank ranked No. 1, earning 829 out of 1,000. Bank of America ranked No. 4, earning 813. The industry average totaled 804.

The full report can be found here.

Eli Sherman is a PBN staff writer. Email him at Sherman@PBN.com, or follow him on Twitter @Eli_Sherman.