PROVIDENCE – Millennials are buying homes in the Providence metro area at a higher rate than they are across the country, according to a new report from Construction Coverage, a company that provides builders with expert reviews and guides to buying technology, insurance, or other products.

The report looks at where millennials are buying homes throughout the U.S., showing that people within this 25- to 34-year-old age group have comprised the largest share of homebuyers in the U.S. since 2014, representing 37% of all homebuyers in the country.

The Construction Coverage report states that in the Providence metro area, millennials accounted for 34% of home purchase loans originating in 2020, compared with 29.7% at the nationwide level.

Among the 55 large metro areas with the highest concentration of millennial home loan purchases in 2020 included in the report, Providence ranked No. 24. The top metro area with the highest concentration of millennial home loan purchases was Buffalo, N.Y., followed by Grand Rapids, Mich., and Pittsburgh. Boston ranked No. 11 with a 36.6% share of millennials making home loan purchases.

There were 5,336 total millennial home purchases that originated in 2020 in the Providence metro area, according to the report. The median loan amount was $275,000, with a median interest rate of 3.1%.

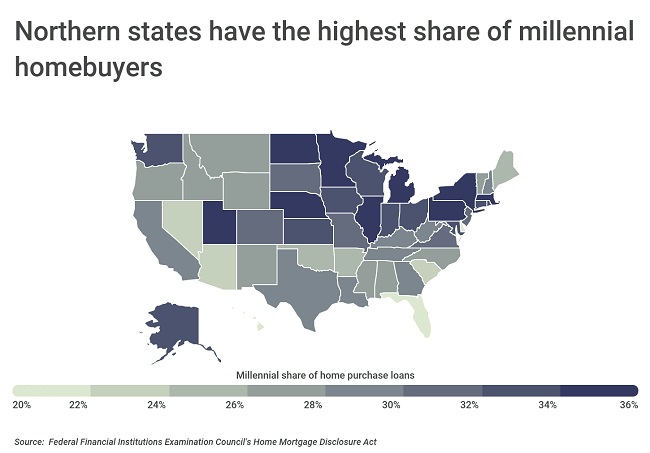

According to the report, the country’s northern states have higher rates of millennial home purchases.

The report also cited a survey of millennial homebuyers in late 2020 that “revealed that over half had accelerated their planned home purchases” in response to the pandemic.

“The drive for homeownership has been strong for millennials, despite the substantial financial pressures they faced,” the report states. “For example, most millennials had no existing home equity to apply to their mortgage loans, as a majority of buyers under 40 were first-time homebuyers. Additionally, even though millennial mortgage applicants have experienced strong income growth in recent years, these salary increases often came from high-tech jobs located in larger metro areas with higher home prices.”

Marc Larocque is a PBN staff writer. Contact him at Larocque@PBN.com. You may also follow him on Twitter @LaRockPBN.