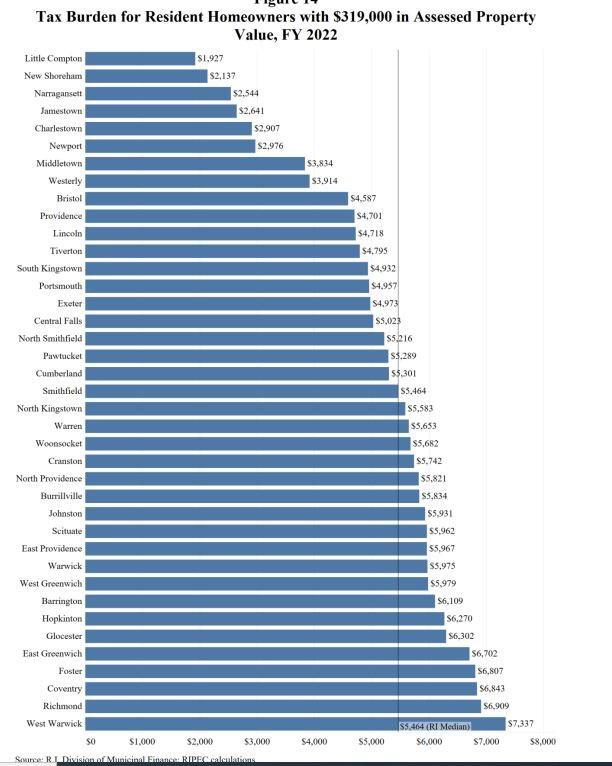

PROVIDENCE – A homeowner in West Warwick pays $5,400 more in annual property taxes for the exact same house than if they lived in Little Compton. If you own a business, your property tax bill ranges even more drastically – up to $35,000 more if you live in Central Falls rather than Little Compton.

And that’s a problem, according to the Rhode Island Public Expenditure Council. The policy research group recently released a report highlighting how disparities in municipal tax rates and policies create imbalances that ultimately hurt communities with lower property wealth, which typically have higher tax burdens.

Indeed, the municipalities with the greatest property wealth generally have much lower tax rates. Little Compton, which boasted the highest net assessed value per capita at $586,153 per person as of fiscal year 2019, also has the lowest residential and business tax rates.

Conversely, cities and towns with less property wealth often have much higher taxes, along with policies such as homestead exemptions that disproportionately add tax burdens to renters and business owners. Central Falls had the least net assessed value per capita as of fiscal 2019 at $24,754 per person but the highest business property tax burden as of fiscal 2022, according to RIPEC calculations.

These imbalances don’t just hurt the people who live and work in communities with higher tax rates. They also raise “serious questions as to overall equity and adequacy of education funding and hindering economic development and affordable housing,” according to the report.

The state’s poorest communities still don’t have the property wealth to fund key city services such as education, while their disproportionally high residential and business taxes can discourage economic development and widen the affordable housing gap, according to RIPEC.

RIPEC recommended a series of changes for lawmakers to consider to remedy these disparities, including “guardrails” that would narrow the different tax class rates across municipalities and limit exemptions that favor homeowners over renters and business owners.

Other recommendations include changes to the state education funding formula to take into account how property wealth affects municipalities’ abilities to pay for education and tangible tax reforms that exempt low-level tangible values from taxation across cities and towns, while potentially phasing out tangible taxes altogether in the long term.

Given that property tax revenue is a key source of funding for municipalities, these changes may cut into cities and towns’ bottom lines, but could be offset with the $536.9 million given to local municipalities through the American Rescue Plan Act.

Nancy Lavin is a staff writer for the PBN. Contact her at Lavin@PBN.com.

So the folks running Little Compton know what they are doing, while the folks running West Warwick and Central Falls don’t. What else is new?

The smart moves would be for West Warwick to merge into Warwick and for Central Falls to merge into Pawtucket.