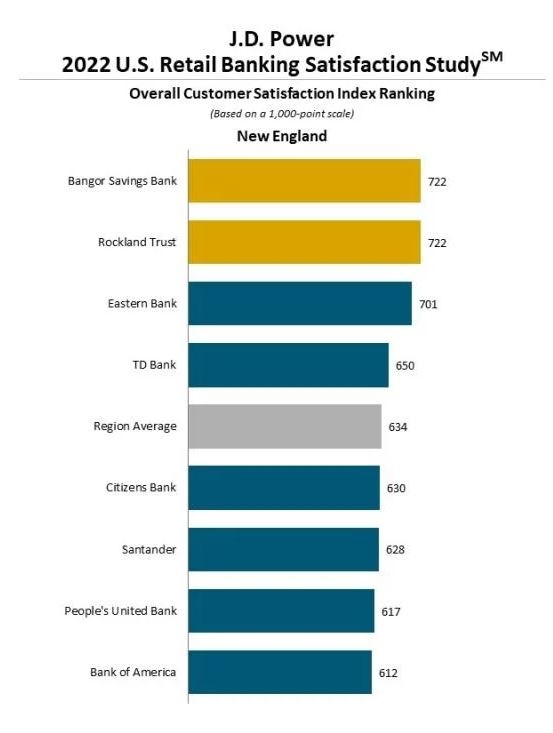

PROVIDENCE – Rockland Trust Co. tied for the No .1 spot among New England banks for customer satisfaction, according to J.D. Power’s 2022 U.S. Retail Banking Satisfaction Study.

The annual survey measures customer satisfaction with retail banks in 15 geographic areas by asking customers to score eligible banks on a 1,000-point scale.

Rockland Trust earned top marks in New England, with a score of 722 out of 1,000, sharing the first-place spot with Bangor Savings Bank in Maine, according to the survey.

The 2022 ranking is the third time the Massachusetts-based bank has been recognized by J.D. Power for customer satisfaction, having also received the top score in 2017 and 2012, according to a news release.

Robert Cozzone, chief operating officer and executive vice president of consumer and business banking for Rockland Trust, said in a statement that the recognition was “a testament to the strong relationship our colleagues have built with the individuals and families we’re fortunate enough to serve.”

The top marks come on the heels of the bank’s $1.2 billion acquisition of East Boston Savings Bank, which closed at the end of 2021.

Rhode Island-based Citizens Bank ranked No. 4 in the region with a score of 630, while Bank of America Corp. came in at No. 7 with a score of 612.

The survey also highlighted new trends in what customers expect and experience out of their banks. Banks that help their customers during challenging economic times received the highest scores – 155 points higher, on average, than those that did not. But more than half of banks are not delivering on this expectation, according to the survey.

“A customer’s definition of what support from their retail bank looks like is changing rapidly as we enter a new economic cycle and move further along the digital adoption curve,” Jennifer White, senior consultant of banking intelligence at J.D. Power, said in a statement. “It’s no longer predominately about being fast, efficient or convenient. The preeminent performance metric with the biggest influence on customer satisfaction is ‘supporting customers during challenging times,’ and that means customers are expecting a personalized mix of financial advice, hands-on help with problem resolution and guidance on how to grow their money.”

Banks are also falling short on scores related to how they help customers save time and money, which had the lowest overall satisfaction ratings. And while many banks have rolled out plans to reduce or get rid of overdraft and low balances fees, nearly two-thirds of customers are not paying attention to whether their banks have done so.

The survey reflects responses from more than 101,000 customers of national, regional and midsize retail banks.

Nancy Lavin is a PBN staff writer. You may reach her at Lavin@PBN.com.