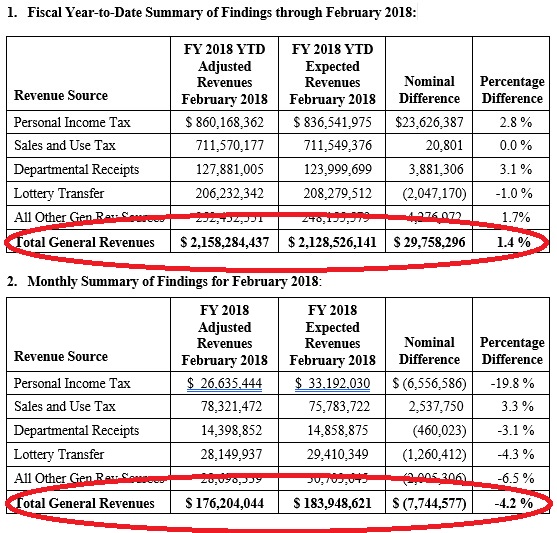

PROVIDENCE – General revenue for Rhode Island is running 1.4 percent ahead of budget through February for fiscal 2018, according to data released Friday by the state Department of Revenue.

The five revenue sources – personal income tax, sales and use tax, departmental receipts, lottery transfer, and other sources – totaled $2.16 billion through the first eight months of the fiscal year, compared with the $2.13 billion that was budgeted for the period.

The report, overseen by Department of Revenue Director Mark A. Furcolo, noted that the 2.8 percent increase to expectations in personal income tax collections through February, $860.2 million, was “likely due to the combination of the recently passed Tax Cuts and Jobs Act of 2017, which caps the state and local tax deduction at $10,000 for tax years beginning after Dec. 31, 2017, and the strong stock market performance experienced in 2017.”

Other year-to-date changes to budget by revenue source included:

- Sales and Use Tax, unchanged, at $711.6 million

- Departmental Receipts, +3.1 percent, to $127.9 million

- Lottery Transfer, -1 percent, to $206.2 million

- All Other General Revenue Sources, +1.7 percent, to $252.4 million

The report looks at the revenue sources in other ways, revealing different details when compared with expectations:

- General Business Taxes, made up of Business Corporation, Public Utilities Gross Earnings, Financial Institutions, Insurance Company, Bank Deposits and Health Care Provide Assessment, -3.6 percent, to $93.7 million

- Excise taxes, made up of Sales and Use, Motor Vehicle License and Registration Fees, Motor Carrier Fuel Use, Cigarettes, and Alcohol, -0.1 percent, to $827.6 million

- Other Taxes, made up of Estate and Transfer, Racing and Athletics, and Realty Transfer, +19.4 percent to $40.8 million

The comparison of February 2018 to the budgeted revenue amounts was not as positive as for the year-to-date figures, a difference that the Department of Revenue once again speculated could be attributed to the federal tax overhaul. Overall, the DOR said that Total General Revenue fell 4.2 percent to $176.2 million. Its component parts reveal significant shortfalls to expectations in a number of areas:

- Personal Income Tax, -19.8 percent, to $26.6 million

- Sales and Use Tax, +3.3 percent, to $78.3 million

- Departmental Receipts, -3.1 percent, to $14.4 million

- Lottery Transfer, -4.3 percent, to $28.1 million

- All other General Revenue Sources, -6.5 percent, to $28.7 million

The report also included a preliminary accounting of the 2017 Tax Amnesty program, which provided a period – Dec. 1, 2017, to Feb. 15, 2018 – for any taxpayer delinquent on any Rhode Island taxes to repay those taxes absent penalties and with a reduction in the applicable interest rate. But payments must be made by March 31.

Through February, the program had collected $15.7 million, 134.2 percent more than the budget had forecast.