PROVIDENCE – Rhode Island continues to rank among the top 10 most “tax-burdened” states, according to new analysis from the Tax Foundation published March 18.

The study, which reflects calendar year 2019 data, ranks states based on the amount of local and state taxes paid by residents relative to the benefits they derive from the net value of national goods and services. This is different than simply ranking states based on the amount of taxes residents pay because local residents are often also paying taxes to local and state entities outside of where they live, the study stated.

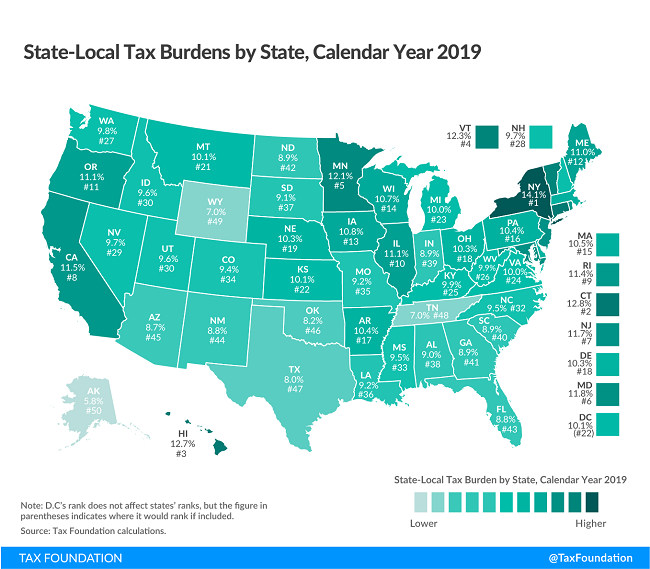

Rhode Island ranked as the No. 9 most-tax-burdened state in 2019, with an 11.4% state-local tax rate, according to the Tax Foundation. Of the $6,334 average tax burden paid per state resident, $4,893 went to Rhode Island, while the remaining $1,441 benefited other states.

Neighboring Connecticut was the No. 2 most-tax-burdened, with a 12.8% effective tax rate, while Massachusetts ranked No. 15 with a 10.5% effective tax rate.

Rhode Island has ranked No. 9 for the last three calendar years of Tax Foundation’s analysis.

Nancy Lavin is a PBN staff writer. You may reach her at Lavin@PBN.com.