PROVIDENCE – A new Citizens Commercial Banking survey of chief financial officers at middle-market companies found that many chief financial officers expect continued economic growth but remain in a “wait-and-see stance” in regard to potential tax changes.

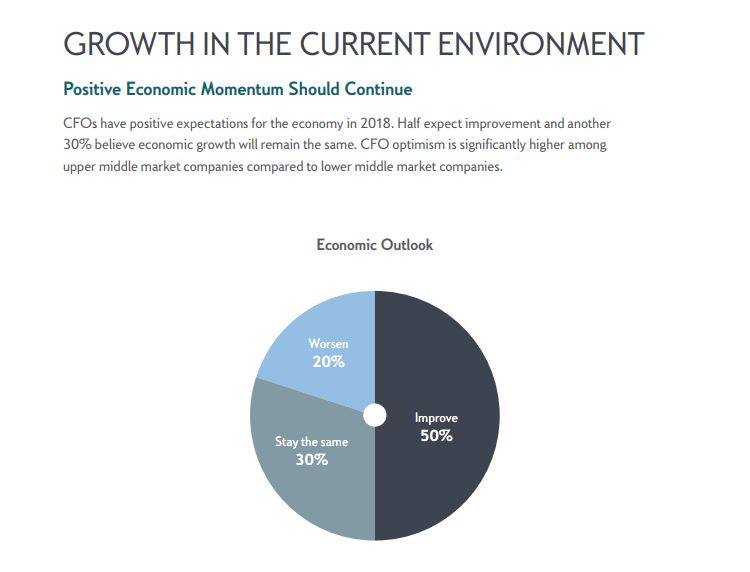

In the survey summary released Thursday, 50 percent of respondents said they have a positive view of the economic outlook in 2018, expecting the growth to improve. Those who think the economic outlook will remain the same made up 30 percent of responses while 20 percent believe the economic outlook will worsen.

Company growth expectations were even more positive, with 55 percent of respondents saying they are extremely confident in 2018 company growth while 36 percent are moderately confident and only 9 percent are not confident their companies will grow.

Tax reform was the most well-received federal policy addressed in the survey, with 60 percent of responses saying federal tax policy will spur business growth in 2018. Only 6 percent of chief financial officers said they expect a negative impact from federal tax policy.

However, responses were less enthusiastic for three other initiatives – trade, regulatory and monetary policies.

Just 25 percent of those surveyed believe federal trade agreement/trade policy will positively impact business growth while 20 percent believe it will negatively impact their business.

Per the ongoing federal regulatory relief process, only 21 percent believe it will positively affect growth while 24 percent believe it will negatively impact growth.

Chief financial officers were more skeptical of proposed monetary policy, with 17 percent reporting it will positively affect growth while 27 percent said it will be a detriment to growth.

The survey was conducted at the conclusion of the third quarter of 2017.

“By and large, the CFOs we surveyed are watching the prospects for tax reform closely,” said Jerry Sargent, northeast region executive of Citizens Commercial Banking, in the report. “However, confidence in the new administration’s ability to enact its pro-business agenda appears to be mixed, and companies are continuing to focus on self-funding of growth initiatives.”

The national survey polled 300 chief financial officers at companies with an annual revenue between $25 million and $2 billion.

In the survey, more than 80 percent of respondents said their objective for 2018 is to continue improving operational efficiencies in the next 12 months. The second-highest response was expansion into new domestic markets at 47 percent and internal development of new products at 46 percent.

While 71 percent of CFOs said they have no plans to pursue an acquisition of another company, the survey found a stark split between upper middle-market companies (over $500 million in revenue) and lower middle-market companies (between $25 million and $500 million in revenue).

Of the upper middle-market company chief financial officers surveyed, 56 percent said they are focused on acquiring another company in the next one to three years. Only 23 percent of lower middle-market respondents said they plan to acquire another company in the same time frame.

Forty-two percent of CFOs of both upper middle-market and lower middle-market companies said the largest reduction of focus for companies is in corporate governance.

For upper middle-market companies, the largest focus was investor relationships (63 percent of responses). For lower middle-market companies, the primary focus was keeping the company properly financed (64 percent).

The survey also found that the role of chief financial officer is changing. Only 10 percent of respondents think the role of CFO has significantly changed in the past three years, and 21 percent expect it to significantly change in the next three.

Also, 29 percent of respondents said the role involves an equal amount of focus on financial and strategy. That said, 61 percent said the focus of the role of chief financial officer is mostly financial with an element of strategy.

Chris Bergenheim is the PBN web editor.