PROVIDENCE – The mortgage delinquency rate, or the percentage of mortgages overdue by 30 or more days, declined 0.7 percentage points year over year to 5.4 percent of all mortgages in Rhode Island in January, according to Corelogic data released Tuesday.

The serious delinquency rate, or the percentage of mortgage payments overdue by 90 days or more, was 2.3 percent in January in the Ocean State, also a 0.7 percentage point decline from January 2017.

In that time, the state’s foreclosure rate declined 0.3 percentage points to 0.8 percent.

However, despite the decline in delinquency, serious delinquency and foreclosure rates in the Ocean State, all of which outpaced national year-over-year recovery rates, Rhode Island’s delinquencies and foreclosures remained above the national average for all three metrics, according to the report.

Nationally, the mortgage delinquency rate was 4.9 percent in January, a 0.2 percentage point decline from one year prior. The national serious delinquency rate was 2.1 percent in January, a 0.2 percentage point year over year decline, while the foreclosure rate also dropped 0.2 percentage points to 0.6 percent in January.

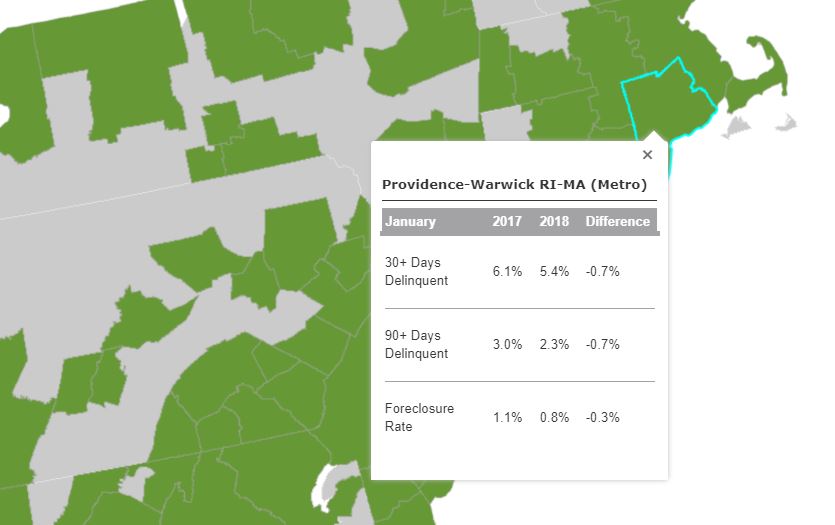

The report also included Providence-Warwick-Fall River metropolitan area data on mortgage payments. The metro area real estate performance for the reason was exactly the same as for Rhode Island. Thirty-day or more delinquency declined 0.7 percentage points year over year to 5.4 percent in January. Serious delinquency similarly declined 0.7 percentage points to 2.3 percent. Foreclosure rates in the metro area were 0.8 percent in January, a 0.3 percentage point decline.

“Except for the metropolitan areas affected by natural disasters, most of the country has seen delinquency and foreclosure rates move lower over the past year,” said Frank Martell, president and CEO of CoreLogic in a statement. “Declines in the unemployment rate have supported a rise in income, and home-price growth has built home equity. These two economic forces coupled with high-quality underwriting have lowered overall delinquency rates.”

In Massachusetts, mortgages in some form of delinquency accounted for 4.2 percent of all mortgaged homes, a 0.6 percentage point decline from January 2017. The Bay State’s serious delinquency rate was 1.7 percent, a decline from 2.3 percent a year prior, and the foreclosure rate was 0.6 percent of all mortgages, a 0.4 percentage point drop from January 2017’s rate.

Chris Bergenheim is the PBN web editor.