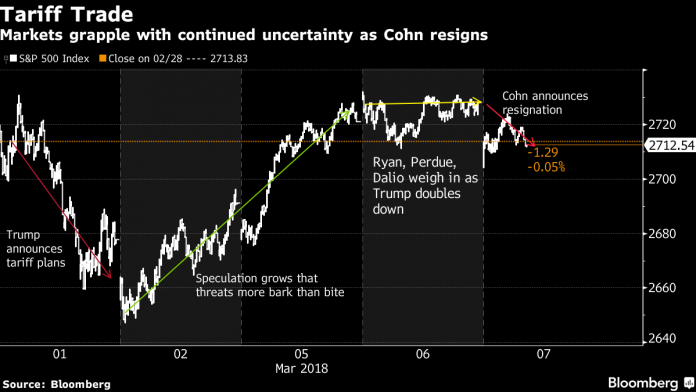

NEW YORK – U.S. stocks erased deep losses as White House officials left open the possibility that President Donald Trump’s tariff proposals will spare neighbors from the most severe penalties. The dollar and Treasuries erased gains.

The Standard & Poor’s 500 index pared gains to trade little changed in trading volume 12 percent below the 30-day average. Investors spooked by the departure of pro-trade adviser Gary Cohn took solace in comments from White House Council of Economic Advisers Chairman Kevin Hassett that indicated the trade policy is not yet finalized.

Trade angst still set the tone in U.S. equities, with multinationals in the Dow Jones Industrial Average leading declines, while domestically focused small caps paced gains. Treasuries pared gains to trade little changed, while Bloomberg’s dollar index fell versus the Canadian dollar after White House spokesperson Sarah Sanders said “there are potential carve outs” for the northern nation in the coming tariffs.

Elsewhere, crude oil fell toward $61 a barrel in New York. Investors also have their sights fixed on upcoming central bank decisions in Europe and Japan, ahead of Friday’s U.S. jobs report.

“I think markets are taking a wait-and-see attitude. But I do believe markets will sell off a lot more if it becomes clear that we are going to start tariffs,” Chris Zaccarelli, chief investment officer of the Independent Advisor Alliance, said by phone. “And if other countries are going to retaliate and people start to wonder how far this is going to go, I think that then there will be more of an impact on the market.”

While the imposition of severe levies on steel and aluminum may come as soon as this week, speculation remains that the tariffs may not spark a broader trade conflagration. The European Union has said it will retaliate in kind, while China has so far remained largely quiet. At the same time, Republican leaders in Congress have urged Trump to target only specific items and countries, adding to hope that a broader crackdown on trade will be avoided.

Here are some key events coming up this week:

- The Chinese People’s Political Consultative Conference runs through March 15 and overlaps with the National People’s Congress meetings in Beijing, through March 20.

- The European Central Bank isn’t expected to change policy on Thursday, but the Governing Council may discuss a change to pave the way for the end of quantitative easing.

- Bank of Japan monetary policy decision and briefing on Friday.

- U.S. monthly payrolls data come Friday.

And these are the main moves in markets:

Stocks

The S&P 500 fell slightly to 2,726.80 at the end of the day after dropping as much as 1 percent earlier in the session. The Dow Jones Industrial Average dropped 82.76 points to 24,801.36. The Nasdaq Composite Index gained 24.64 points to close at 7,396.65. The Stoxx Europe 600 Index gained 0.4 percent, third gain in a row. The MSCI Emerging Market Index dipped 0.5 percent.

Currencies

The Bloomberg Dollar Spot Index was steady. The euro was steady at $1.2401. The British pound rose less than 0.1 percent to $1.3891. The Japanese yen advanced 0.1 percent at 106.03 per dollar. The MSCI Emerging Markets Currency Index increased 0.1 percent to the highest in more than a week.

Bonds

The yield on 10-year Treasuries was little changed at 2.886 percent. Germany’s 10-year yield decreased two basis points to 0.66 percent. Britain’s 10-year yield fell three basis points to 1.494 percent.

Commodities

West Texas Intermediate crude slid 2.3 percent to $61.14 a barrel. Gold slipped 0.8 percent to $1,323 an ounce.

Randall Jensen is a Bloomberg News staff writer.