For Marc Perlman, principal owner and CEO of Ocean State Job Lot, the Federal Reserve’s outlook for 2020 is the best business fortune he could have hoped for.

After cutting interest rates three times in 2019, the Fed has indicated it plans to hold rates right where they are for the next 12 months. A low, stable interest rate means discount retailer Job Lot can increase its capital investments, maintain inventory and continue its buy-up of shopping centers and freestanding locations, all for a lower borrowing cost.

And it’s not just businesses that benefit, according to Perlman.

“A low interest rate environment is really quite excellent for almost all parts of the country,” Perlman said. “If you’re buying car parts, thinking about purchasing a home, or just buying a burger at McDonald’s … everybody wins.”

Everybody except banks, that is. Lending long and borrowing short has long been the model by which banks make money. But when interest rates are low, the spread between the income generated from lending money and the expense of holding deposits shrinks, lowering bank profits.

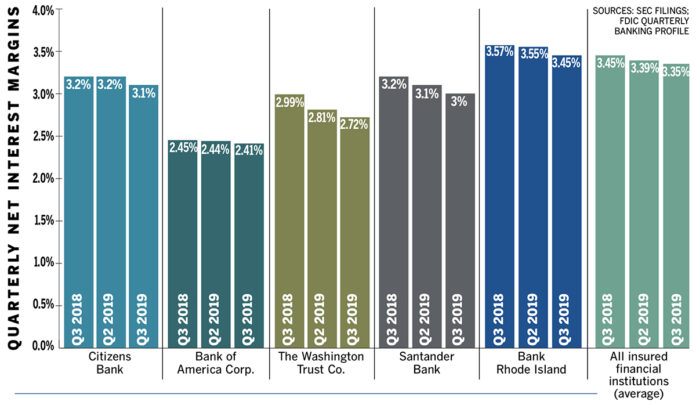

Federal Deposit Insurance Corp. data show that banks nationwide have seen their net interest margins – the difference between interest income and what is paid out to depositors – contracted steadily over the course of the year. The average national interest margin of all insured institutions decreased by 10 basis points in the last year, from 3.45% at the end of the third quarter of 2018 to 3.35% 12 months later.

Local banks and financial institutions have suffered a similar squeeze, perhaps worsened because deposit rates have not dropped as quickly as those on the lending side – a factor of stiff competition among the high concentration of brick-and-mortar banks and nontraditional deposit holders such as stock brokerage firms and financial technology companies.

‘We have multiple levers we can pull.’

SAM HANNA, Webster Bank senior vice president and director of middle markets

The Washington Trust Co., for example, saw its net interest margin drop 27 basis points, from 2.99% in the third quarter of 2018 to 2.72% a year later. At the same time, the bank’s cost of interest-bearing deposits increased from 0.78% in the third quarter of 2018 to 1.13% by the close of the third quarter 2019.

Deposit rates historically lag behind market changes, but competition is definitely a factor too, said Mark K. W. Gim, president and chief operating officer of Washington Trust.

“With the advent of these fintech companies, you can deposit money anywhere in the U.S., not just in Rhode Island,” said Edward M. Mazze, a distinguished professor of business administration at the University of Rhode Island. “Banks aren’t just competing locally, they are competing regionally and nationally.”

How to plan for a year of low interest rates and stiff competition? Local bank leaders say the key is diversifying their sources of revenue.

Keith Kelly, Citizens Bank’s Rhode Island market president, pointed to several recent acquisitions that better position Citizens to handle market fluctuations. With the additions of merger-and-acquisition firm Bowstring Advisors and Franklin American Mortgage Co., Citizens can capitalize on the expected boom in both the mortgage and mergers-and-acquisitions industries, charging fees for its services that will help to offset a flat yield curve.

Meanwhile, Connecticut-based Webster Bank will be looking for growth on its commercial and industrial loans, both new and existing loans for floating-rate customers, as well as its health savings account division, HSA Bank, which reported $32.8 million in pre-tax revenue for the third quarter of 2019, up 16.6% from the same period a year earlier.

“We’re not a one-trick pony,” said Sam Hanna, senior vice president and director of middle markets for Webster Bank. “We have multiple levers we can pull.”

Gim agreed, naming mortgage banking and wealth-management service revenue as Washington Trust’s other primary income sources.

“The advantage of multiple sources of income is that if one is down, another can pick up the slack,” Gim said.

Even with these diverse offerings, banks should expect their yield curves to remain relatively flat in the current interest rate environment, said Michael Ice, a senior lecturer on finance at URI’s College of Business.

Ice said financial institutions should use this period as a time to clean up their portfolios – not necessarily changing them but monitoring them more aggressively.

What that doesn’t mean, Ice warned, is lending more aggressively. The last time banks slipped into reckless lending practices to offset lower interest margins led to a collapse of the financial system.

It’s also a great time to invest in better services, and not necessarily the face-to-face interactions with tellers, either.

“The way people bank has changed dramatically,” Ice said. “If your platform is cutting edge and efficient, that’s the way to go.”

To that end, Citizens Bank has partnered with several fintech and startup firms, as well as launching its entirely digital banking platform Citizens Access, which Kelly cited as key sources of growth and focus in the coming year.

As for the looming shadow of an economic downturn, local bank leaders remained alert but optimistic that the growth trend will continue in 2020.

“This economic cycle is pretty long in the tooth,” said Gim. “Is it in the ninth inning now? Not necessarily, but it could be the bottom of the sixth or top of the seventh.”

Nancy Lavin is a PBN staff writer. Contact her at Lavin@PBN.com.