PROVIDENCE – Rhode Island is again listed among the states with the worst tax environments in the nation, ranking 42nd in a new report published by the Tax Foundation.

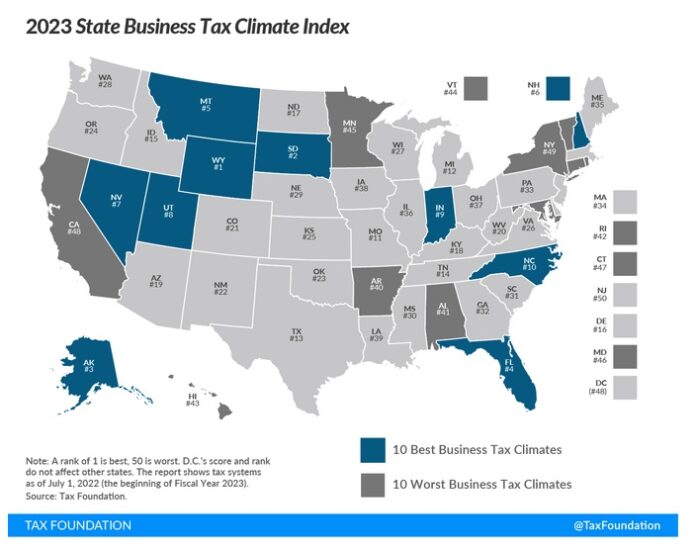

The 2023 State Business Tax Climate Index compares tax policies across 50 states as of July 1 for competitiveness and impact on businesses, scoring each with an overall rank, as well as individual scores based upon corporate, individual income, sales, property and unemployment insurance taxes.

Rhode Island’s latest score marks a slight drop from a year ago, when it ranked 40th. Since 2014, the Ocean State has consistently fallen to the bottom third of the pack, with rankings from 37th to 44th, according to the Tax Foundation.

Rhode Island’s sales tax score – which incorporates both state and local taxes – was its bright spot, ranking 24th. However, the Ocean State came in second to last at 49th for its unemployment insurance taxes.

Rhode Island also ranked 40th for its corporate taxes and 41st for its property taxes.

In terms of overall tax environments, neighboring Massachusetts fared slightly better, with an overall score of 34, while Connecticut was ranked 47th.

Wyoming took the top spot for best tax climate in the nation, while New Jersey ranked last.

The report emphasized the importance of state tax policies to businesses, informing in some cases where they choose to move or locate, job creation and growth, profits and, in turn, the overall state economy.

Great job, Dan & Gina!

Who cares? Notice how we keep company with New York and California. Say what you want, but there is no denying the fact that those two states lead the nation in business creation and world domination in many, many metrics. This “survey” is nothing more than a wish list from the 1% to try and influence our tax code to suit their needs. Investing in education and our workforce is what creates wealth and job opportunities not making sure the rich pay less taxes.